The Nov US consumer price index report is due at 1330 GMT (8:30 am ET) on Tuesday

The Fed is pleased with the level of jobs growth in the United States and believes the country is close to full employment. Their worries about the global economy have subsided, at least for the moment.

The big question at the FOMC will be inflation and that's why Tuesday's report matters. The decision to hike rates is probably a done but forecasts and other communication could be altered based on the CPI data.

The Fed generally prefers the PCE report as a gauge of inflation but they also closely monitor CPI.

What's expected in the CPI report

- CPI inflation expected up 0.4% year-over-year and 0.0% month-over-month

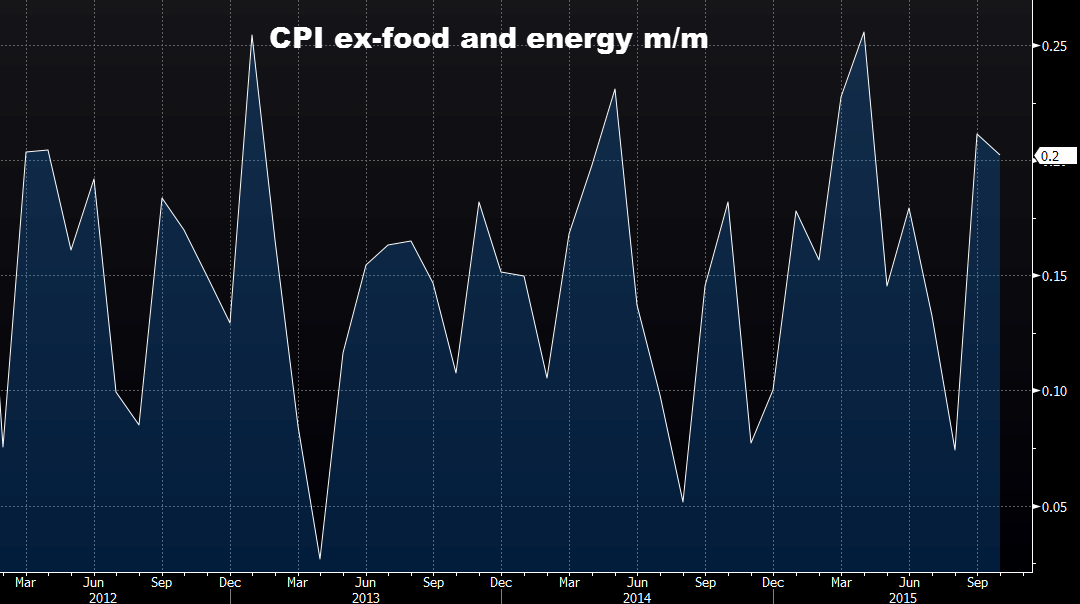

- CPI ex-food and energy expected up 2.0% year-over-year and +0.2% m/m

The headline number is nowhere close to a level that should cause the Fed to hike so officials are focusing on core inflation. The hawks believe it's a sign that once commodity price drops filter through the data, inflation will return to target.

Of course, the hawks have made a dozen arguments for why sustained 2% inflation was just around the corner over the past 5 years and been proven wrong repeatedly.

The gauge I'll be watching most closely is CPI ex-food and energy m/m. It's risen by 0.2% for the past two months. A third month would put inflation at annualized rate above 2.5%, which is easily high enough for the Fed to hike.

What will the US dollar do?

The market is extremely delicate at the moment with Wednesday's FOMC decision looming. Trading has been whippy, sentiment driven and dangerous.

It will take at least a two-tick miss to really change anyone's ideas about how the Fed will communicate Wednesday.

To me the risks are skewed to the upside for the US dollar. If core inflation is high, the market will worry excessively about a hawkish Fed and the dollar could rally strongly. If core inflation is low, it is more likely to be brushed off as a passing trend.