Final Q3 reading now out

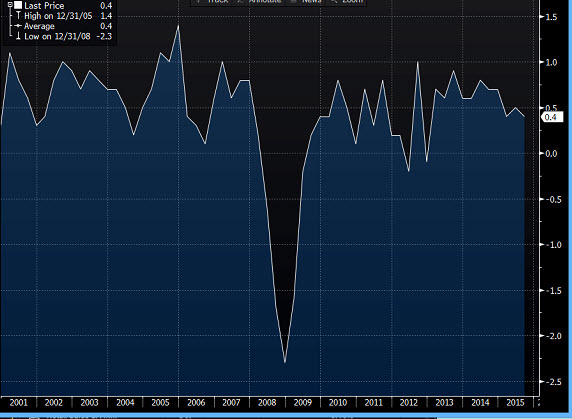

- +0.5% prev

- yy +2.1% vs +2.3% exp/prev

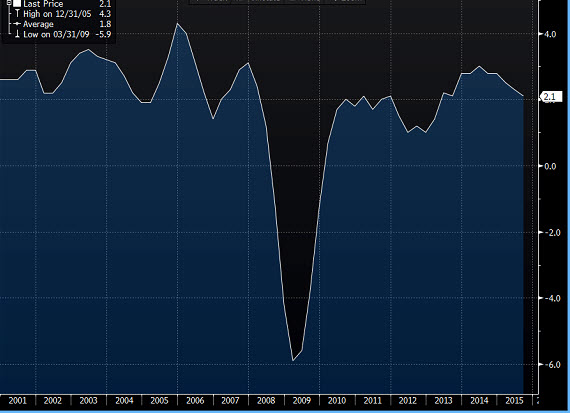

- Q3 Current Account £-17.5bln vs -21.5bln exp vs -17.5bln prev revised down from -16.8bln

- Q3 labour costs +2.0% yy, +0.3% qq

- total business investment qq +2.2% as exp/prev

- household disposable income qq +0.5%

- yy +5.8% vs +6.6% prev

- index of services mm +0.1% vs +0.2% exp vs +0.5% prev revised up from +0.4%

- 3mth/3mth +0.5% vs +0.6% exp/prev

- Lloyds business barometer 45 vs 55 prev

Not good news for the GBP bulls and the pound is slipping albeit not tumbling. Better than exp c/a data helping to temper losses as is higher household disposable income

Re current account data the ONS says

The total trade deficit widened to £8.7 billion in Quarter 3 (July to September) 2015, from £4.7 billion in Quarter 2 (April to June) 2015. This was primarily due to a £5.4 billion widening in the trade in goods deficit partially offset by a £1.4 billion widening in the trade in services surplus.

Full data releases from the ONS here

GBPUSD 1.4838 EURGBP 0.7361