No fireworks from the pound after GDP but some relief from the numbers

Less than half the data that makes up the final GDP is used for the preliminary data so, as Mike correctly pointed out, the revisions can mean more than the flash numbers.

The service industry makes up the biggest part of GDP at around 70-75% and that rose 0.7% vs 0.4% in Q1 q/q, and 2.7% vs 3.1% prior y/y. That helped keep GDP from dropping

Mining and quarrying also posted some very good numbers which were driven by tax cuts brought in buy the government in March. That's helped to offset rising operating costs in the sector. It's also gone someway to reduce the effects of falling oil prices for that part of the sector

It's one of the few times that a government initiative on taxes has actually done some good, but you can bet that it's being taken from elsewhere

Tax cuts don't usually last too long so these effects may be reversed somewhere down the line

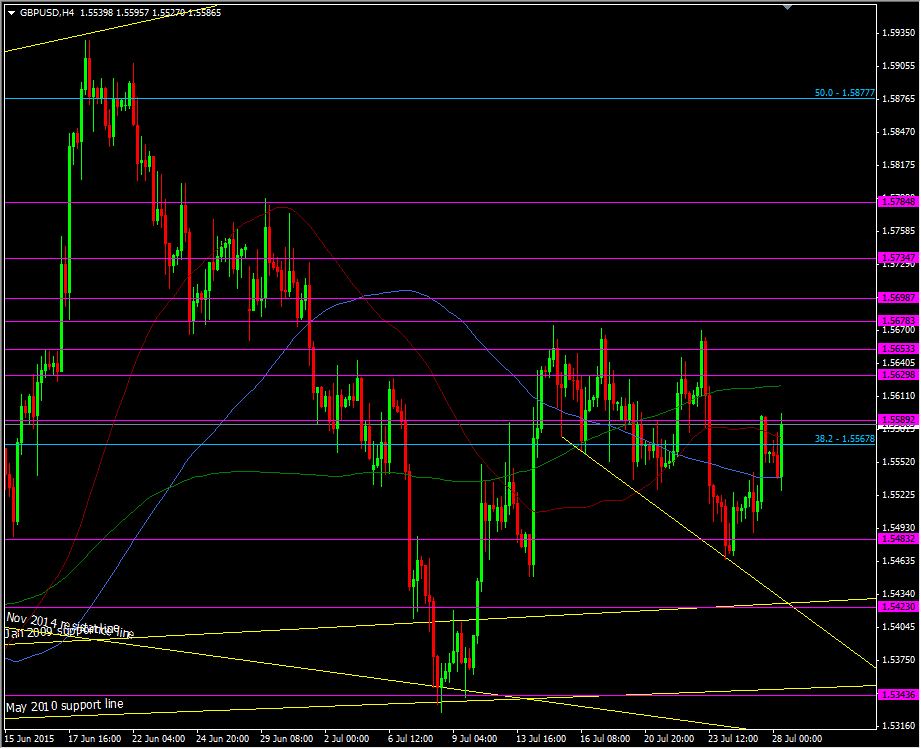

GBPUSD is up testing yesterday's highs at 1.5590, which holds resistance ahead of 1.5600. Has broken to 1.5604. If we are to push higher then we'll need to clear this area and build above 1.5600 or we'll be sucked back into the dollar strength we saw before the numbers

GBPUSD H4 chart

The upside levels through 1.5600 are well defined and support should now come in around 1.5570/80, 1.5540/50 and 1.5520/25

Overall, the numbers take some of the sting out of a poor first quarter and that's giving the pound some relief. It doesn't scream "raise rates tomorrow" but it won't change the thoughts of the MPC and their decision on when to raise. Growth could obviously do better but these numbers strongly keep the possibility of the votes changing at the next meeting, and I still think buying the pound a day or two ahead of it (or on any decent dip) is the trade to be in