UBS comments on the People's Bank of China and the RMB

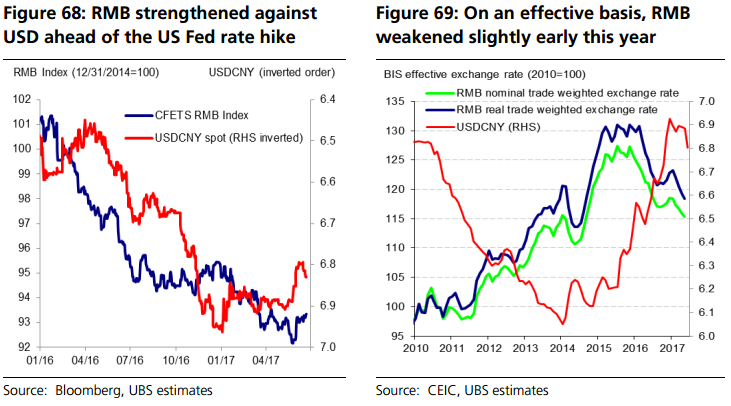

CNY appreciated sharply against USD ahead of the Fed rate hike, moving from 6.91 in early May to 6.79 by June 14.

- It has since retraced some of that move, which we think was more a case of the CNY playing catch up with recent dollar weakness.

- YTD, the RMB has strengthened ~1.7% against USD but weakened ~1.6% against the CFETS basket, in contrast to 2016 when it depreciated against both USD (~7%) and the basket (6.3%).

Successive upgrades to PBC currency framework.

- After shifting its daily fixing strategy in late 2016 to better anchor onshore sentiment, the PBC adjusted its methodology again in February to lessen the impact of each day's depreciation on the next day's fixing (by reducing market movement calculation over-laps).

- The more recent "countercycle" adjustment in May will help to lessen the momentum-driven nature of its previous fixing formula, increasing USDCNY stability.

- Capital controls also continued to be intensified and measures to encourage more inflows enhanced.

And, the forecast from UBS ...

USDCNY to stay broadly stable for rest of the year.

- Factors that have supported YTD USDCNY stability include: weaker USD momentum despite tightening Fed, tighter capital outflow controls, subsiding risks of US-China trade war, and improved USDCNY sentiment - most of which we don't see changing sharply any time soon, thus our expectations for USDCNY to end 2017 not beyond 7.

- UBS does not expect the USD to strengthen in 2018, which combined with persistent outflow controls and political pressure on CNY means that USDCNY will unlikely move beyond 7.1 by end-2018.

- Upside for CNY is also limited - if the USD weakens further, any CNY appreciation will likely be partial (allowing for some depreciation vs. basket), so as to leave some room for USDCNY stability in case the USD strengthens again.

(bolding mine)