Fed didn't try to send a message.

Three reasons it's going to be tough to hike at the March 15 meeting:

- There were no dissents. Not even that hawks are pushing to hike. Usually you get a few of them leaning out ahead of the pack.

- Not convinced on business investment. The GDP report showed the first bump in business investment in five quarters but the Fed isn't convinced it's anything but a blip. That's the right call but they passed up an opportunity to offer a hawkish tilt.

- Near-term risks still roughly balanced. The Fed's biggest opportunity to send a message was in the balance of risks and there is no change in the guidance.

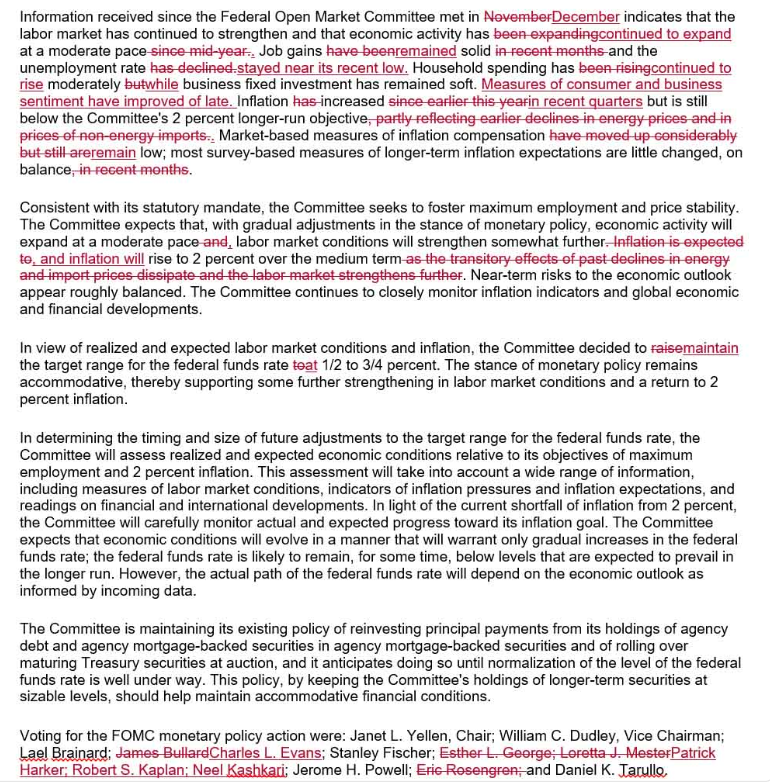

Here's the full redline, via Zerohedge.

In terms of market reaction, the US dollar kicked about 50 pips lower across the board on the decision. I'll refer to what I wrote just before the decision:

"The kneejerk will be US dollar selling but I don't think it will last unless they include something in the statement to highlight uncertainty."