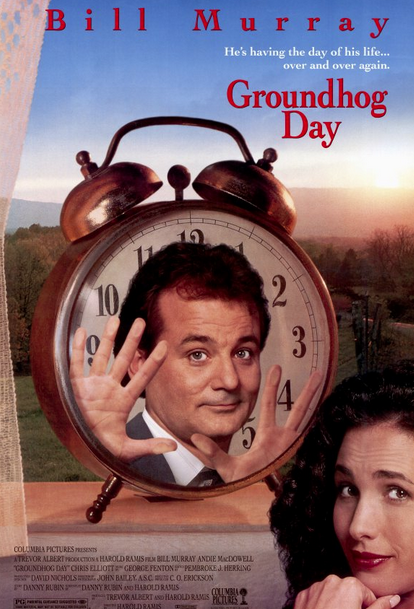

Okay, campers, rise and shine, and don’t forget your booties ’cause it’s cooooold out there today. February 2 is Groundhog Day and before I tell you whether Punxsutawney Phil saw his shadow, here are three signs you’re caught in a Hollywood-style time trap in financial markets.

#3 – Everyone is worried about a Chinese slowdown

You can really trace all the emerging market jitters back to the soft HSBC flash China manufacturing PMI on Jan 23. That’s the day the S&P 500 rolled over and emerging market currencies plunged.

#2 – The euro has broken below technical support and everyone is bearish

Everyone hates the euro and with disappointing inflation and a break to a two-month low, there are plenty of reasons to sell.

#1 – Greece has a funding shortfall

On Friday, the Wall Street Journal reported that France and Germany held a secret meeting about the state of Greek finances because of a new €5-6 billion shortfall. Oh, and stop me if you’ve, heard this one before, they want … austerity.

The worst news of all is that Punxsutawney Phil saw his shadow and that means 6 more weeks of winter.