That's the one thing I hate about huge moves, it screws up your charts

Now the dust has settled somewhat and we're only subjected to 100 pips swings instead of 800 pips swings, we can try and look at the picture we face now.

Yesterday in our Brexit webinar, Greg and I knocked a few charts around between us. I took a look at the yearly while Greg brought it in a bit.

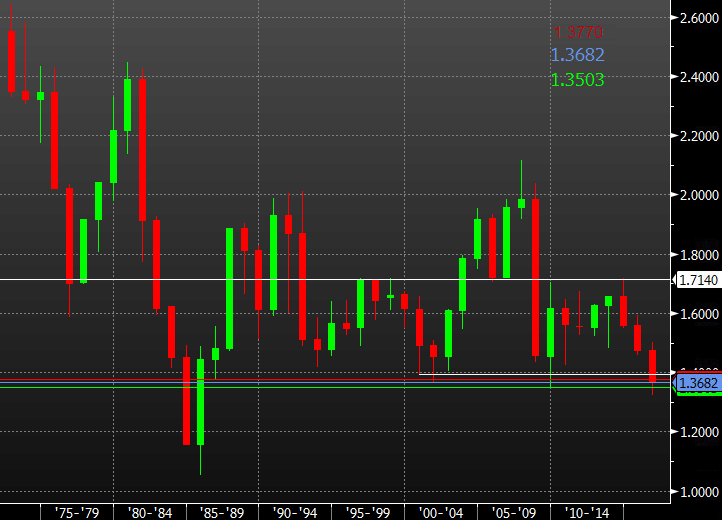

There were some strong levels on the yearly chart but we went through those like butter and at the moment they're not counting for much now either.

GBPUSD yearly chart

I think the 1.3500 level could become important again, at least for containing today's moves. The US making their Brexit trades will have a say in that. Back in Feb I highlighted these levels for longs and at any other time I would be loading up positions for the long haul. Right now there's still a lot of uncertainty so I won't be looking long-term. For a shorter term trade I'm keeping my eye on the 1.3500 for a long if we test and hold again.

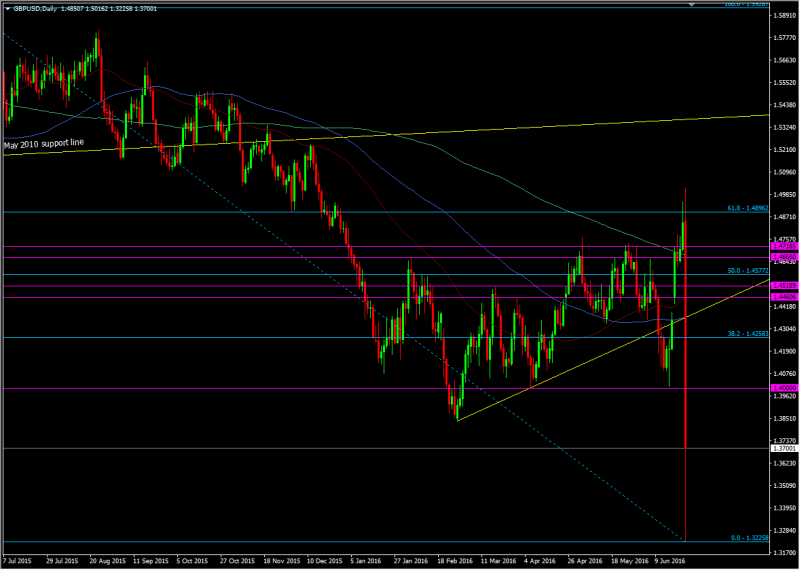

On the daily chart, while musing about if we should use it to trade over this event, I said I probably wouldn't but if I did I'd be looking for the strongest places on it.

GBPUSD daily chart

That would have been at the 100 dma and trendline at 1.4350/60, and then the 1.40 level.

There's not much we can do with that big red bar on the daily so that's when I switch down to my favoured 15m chart to see the levels developing today. Lo and behold, where do we find the main resistance?

GBPUSD 15m chart

It's right on the 1.40 level I picked out for support yesterday. Also, since the bounce this morning we've seen support build just above 1.3500, the big yearly level I'm watching now.

Even though things are still choppy, we've got two definitive levels to use to guide us. Test and hold either and we can feel confident in grabbing a trade. Fail and break and there's the potential to go with that move.

Now we're through the other side of the Brexit vote, I'm happier to think about trading the pound again. It's far from out of the volatility woods but the tech is more likely to re-assert itself and thus become somewhere I can lean against and define my risk.