This is why central banks failing to understand what's going on causes so much damage

For the past six weeks, whenever almost any central banker has been asked about market volatility they've either dismissed it, or placed some kind of vague blame on China.

Today Yellen said the "most notable" reason for worries is that "declines in the foreign exchange value of the renminbi have intensified uncertainty about China's exchange rate policy and the prospects for its economy."

You're telling me that a 1.3% decline in the yuan this year has caused this?

There is one big problem in the global economy and once everyone understands it, markets and central bankers can focus on what needs to be done to counteract and insulate. The problem: Supply.

There is nothing shocking happening in China. Yes, policymakers have stumbled and that's hurt confidence and there are some capital outflows and mixed messages on the yuan. Big deal. Yes, it's an opaque economy and at some point there will be a brutal recession there but there's no evidence that it's happening now.

Here is what's happening

Low interest rates lured far too much investment in commodities. Money poured in from markets and sovereign wealth funds into developing every marginal energy or mineral deposit on the planet.

Production is now far exceeding demand and prices are cratering. That's devastating for companies that produce those commodities and countries that export them.

Yes, there are other problems in the world and the global economy is so vulnerable to this because even at full-tilt developed economies can only grind out 3% nominal growth.

But the supply story is what's new.

If Yellen were to come out and outline the problem, the risks and talk about how the Fed was attempting to insulate the financial system from commodity-driven shocks, then everyone would be better off.

Companies listen to central banks and this is what happens when central banks don't know what's going on.

"There seems to be an emotional reaction that's occurring right now," Cisco CEO Chuck Robbins said today about the economic climate. "You see the markets get rattled, which causes our customers to get concerned, which causes them to tap the brakes, which causes CEOs of public-traded companies to be cautious, which then rattles the markets more -- which creates this vicious cycle. We have to be careful that we don't create some self-inflicted dynamic here."

Central banks need to wake up and provide some clarity. This is the age of oversupply. It's not just commodities; there is no scarcity any more. It changes every economic model and they absolutely don't understand it.

What's the trade

At some point, the Fed, executives and markets are going to get a handle what's going on. I think that might be good news. The companies -- like Cisco -- that are largely removed from commodities can resume spending and investing. They can avoid commodity-exporting countries like Brazil invest in importers like China and the United States.

The risk is that this drags on. That the Fed and other central banks remain utterly clueless and all companies retrench into the self-defeating vicious cycle Robbins outlines.

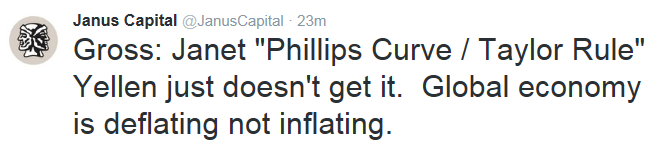

At the moment, you just can't make any kind of bet that central bankers will soon 'get it'. What's really needed is a wholesale clear our of central banking circles and to put some fresh thinkers in charge.

Update: I made a video explaining what's really roiling global financial markets.