Here is an interesting tidbit from RBS Securities economist Guy Berger; he says the US dollar is not up 20%, that's misleading ... its up around 10%

He says:

- The "commonly-cited '20% appreciation of the dollar' statistic is misleading"

- Avoid using the US dollar index (DXY) as a gauge of impact for the US economy

- The DXY includes only the EUR, Yen, JPY, GBP, CAD, SEK and CHF, while the Federal Reserve's published "major currencies" series has these currencies along with AUD ... these account for only around 43% of US international trade

BUT ... these both omit several large US trading partners (Mexico, China, Korea, Taiwan, Brazil, & various Asian countries), many of which "have higher trade weights than some of the 'major' ones" .... these make up the other 57%

- Says a "broader trade-weighed dollar index" is up about 14% since late June

And, another big BUT (maybe I should throw in Sir Mix-A-Lot here) ... the Federal Reserve's real trade-weighted USD index through to February has appreciated by about 10%, and through to March around "12% real appreciation relative to June 2014"

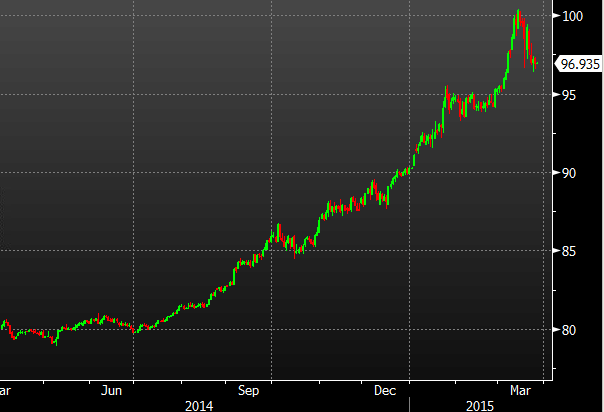

The DXY over the past 12 months ... but don't use it says RBS's Berger