Look for peak around the end of the first quarter

From CIBC World Markets:

The beginning of the Fed's tightening cycle combined with increasing market volatility might have looked like a recipe for further US dollar appreciation. But the Fed's move was already baked into markets and volatility came alongside a paring back of short positions in other currencies. As a result, the ingredients on hand weren't sufficient to spur another run up in the dollar.

Nevertheless, the outlook for the first quarter suggests that there's one last leg of USD strength remaining. A March rate hike, which isn't fully priced in at the moment, will refocus currency markets on the divergence in policies between the Fed and other major central banks.

As the quarter progresses and markets regain their appetite for risk, short positions will also be reestablished in funding currencies like the euro and yen, causing them to weaken against the dollar. All told, the USD should appreciate against a wide range of currencies and reach its peak around the end of the first quarter.

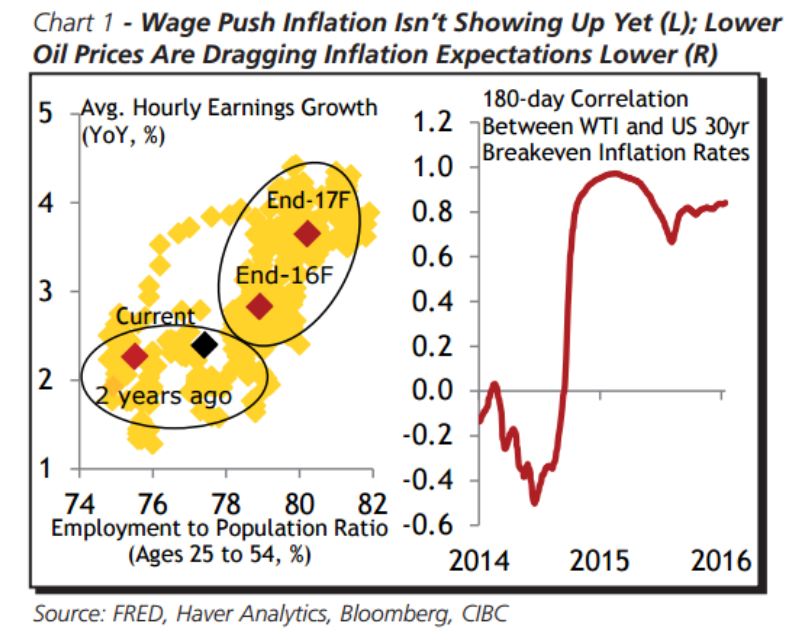

But following that bout of strength, the dollar's twoyear bull run will be fully cooked. With prime-age employment rates remaining below the threshold usually associated with accelerating wage, inflation pressures emanating from the labour market will take longer to show up than the Fed currently predicts. In addition, renewed weakness in commodity markets will provide a headwind for both headline inflation and inflation expectations right). While Increasing healthcare costs could provide some counterweight to those price pressures, they won't allay the Fed's concerns about prices, especially in the first half of the year.

As a result, together with lingering uncertainty about the international backdrop, weak price gains and lower breakeven inflation rates will cause the Fed to take a long pause following a March rate hike meaning the USD will be set to cool on the window sill.

The Fed's renewed patience will come just as other economies begin showing signs of strength this year. Around the middle of the year, the euro area and other advanced economies will truly be reaping the rewards of past stimulus. Moreover, in contrast to the current account surpluses seen in economies like the euro area, the US' deficit will also weigh on the greenback post Q1. Together with a cautious Fed, that should see the USD lose ground against most major currencies beginning in Q2 with the pullback extending well into 2017.

For bank trade ideas, check out eFX Plus.