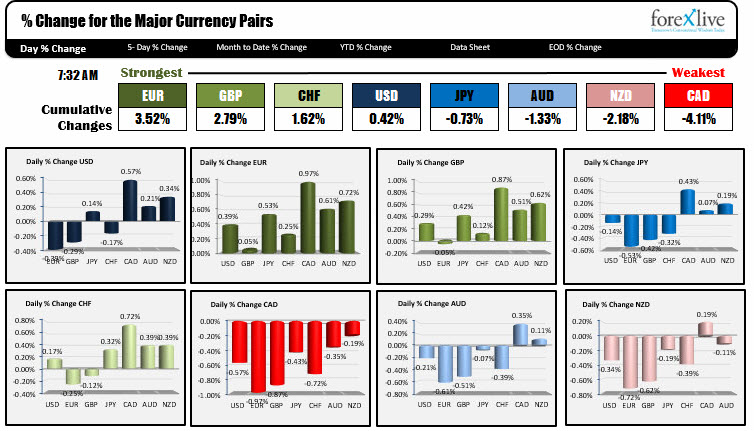

New month. February 1, 2016. The EUR is the strongest. The CAD is the weakest.

The strongest currency as North American traders enter for the trading week is the EUR. The weakest are the commodity currencies led by the CAD.

Oil prices are at at $32.33 down over 3.5% on the day. That has sent the CAD back down. Stocks are also lower as well today, with the European major indices showing declines of >1%. The US pre-market has S&P futures down 13 points. Gold is at $1123 or +0.6%.

In the European session, the Eurozone PMI data came out as expected at 52.3. Spain was better. Italy was worse. France came in as expected. Germany was better. By the way, the UK PMI came in better than expectations (52.9 vs 51.8 est).

Later today at 11 AM ET, ECB Draghi speaks in EU parliament debate on ECB annual report. Also today the US Personal income (est +0.2%) and spending (+0.1%) will be released (8:30 AM ET) along with US core PCE (est +0.1%, +1.4% YoY). US ISM manufacturing index is expected to rise to 48.5 from 48.0 (revised) along with construction spending (est. +0.6%. Those releases come out at 10 AM ET. RBC Canada Manufacturing PMI will be released at 9:30 AM et (Last 47.5).

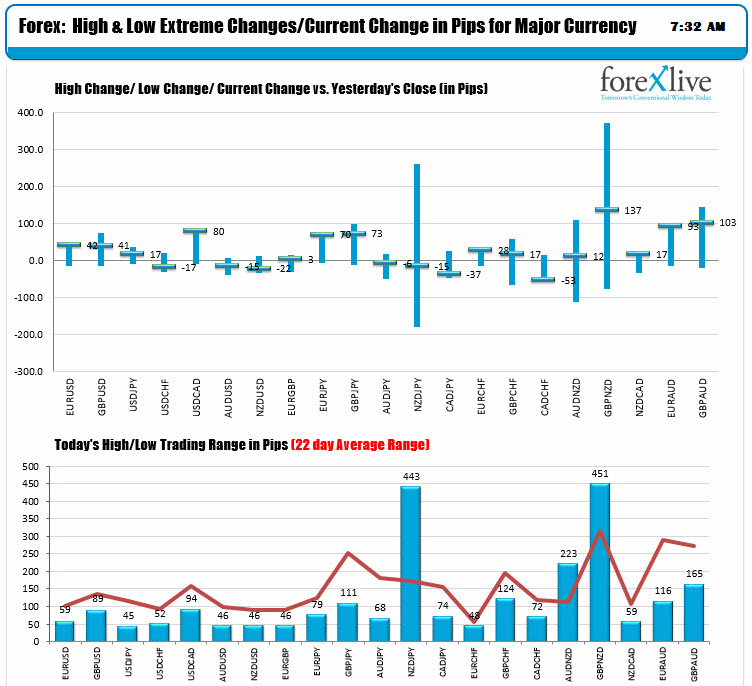

The low to high trading ranges for all the major currency pairs or below the 22 day averages. There is room to roam.