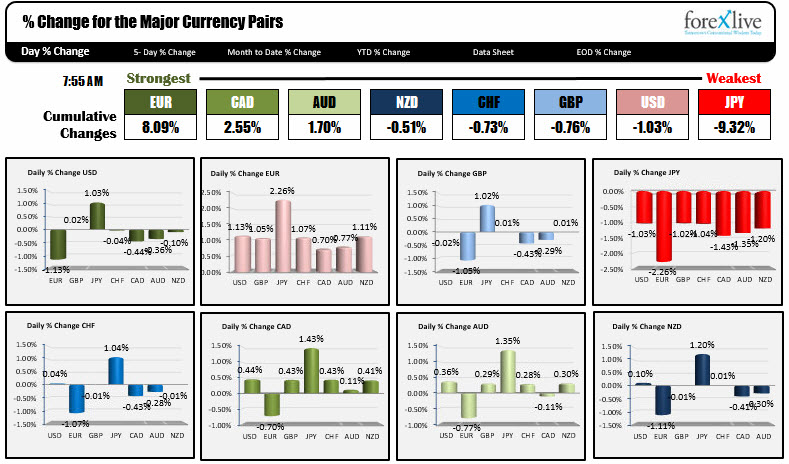

The EUR is the strongest. The JPY is the weakest.

The EUR took a collective breathe on the back of Macron/LePen matchup for the 2nd round. That makes the EUR the runaway favorite. Over on the weak side, the JPY is "flight out of the safety of the JPY" trade. Stocks are up, bond yields are up, and gold is down and that has been spelling lower JPY. If you add up the % changes of the major currencies, the JPY sum is actually larger than the EUR's sum.

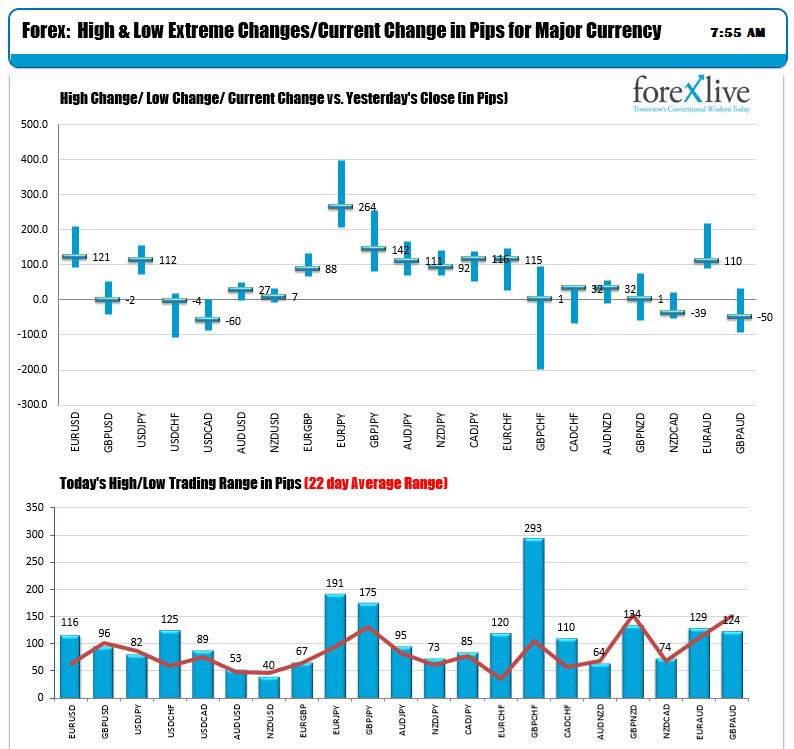

The ranges in the lower chart are just the high/low trading ranges since the opening. So they do not include the gaps from Friday's close. Most of the ranges are on par with the 21 day averaged. The JPY crosses - especially EURJPY and GBPJPY - are well above the averages (and remember that does not include the gaps). What is also of significance from the charts below is we are near the bottoms for most of the JPY crosses, and the EURUSD. So there is some profit taking going on in the markets. Gaps are still far from being filled though.

On the economic calendar:

- Canada wholesale trade sales for Feb (-1.0% est vs 3.3%

- Chicago Fed Nat Activity index for March +0.50 vs +0.34

Feds Kashkari is scheduled to speak at 11:30 AM ET and then again at 3:15 PM

A snapshot of other markets:

- Gold $1267.83, -$16

- WTI crude oil $49.90, +$0.29

- S&P futures up +27.25, Nasdaq futures up +59.75, Dow futures up $217

- US bond yields has 2 year up 7.3 BP to 1.25%, 5 year up 7.6 BP to 1.8466%, 10 year up 6.2 BP to 2.312%, 30 year up 5.5 BP to 2.9571%