January 29, 2016: The

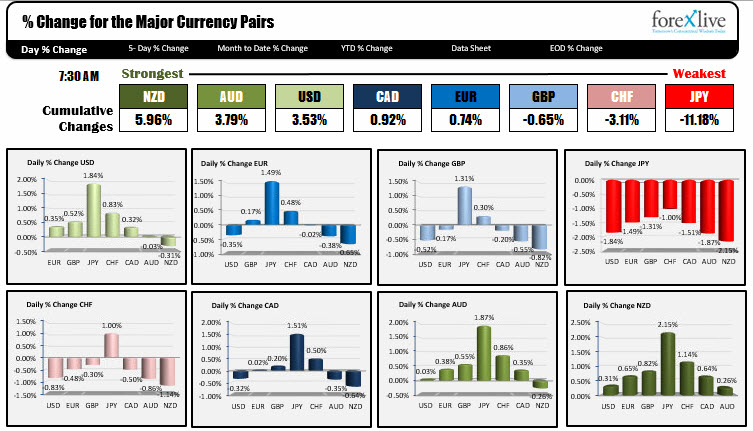

The strongest currency is the NZD today. The weakest is the JPY. Japan adopted a negative rate policy and that spiked the USDJPY straight to the upside. The high reached just short of the 200 day MA at 121.45 (my high comes in at 121.383, Bloomberg comes in a few pips higher). The strongest currency is the NZD and the AUD. The strength in those currencies is centered vs the JPY. The changes vs. the dollar are fairly contained. The greenback is higher as well today- doing better against all currencies with the exception of the NZD. Today the US GDP will be released at 8:30 AM with the estimate at 0.8%. Personal consumption - 70% of so of GDP is consumption - is expected to rise 1.8%.

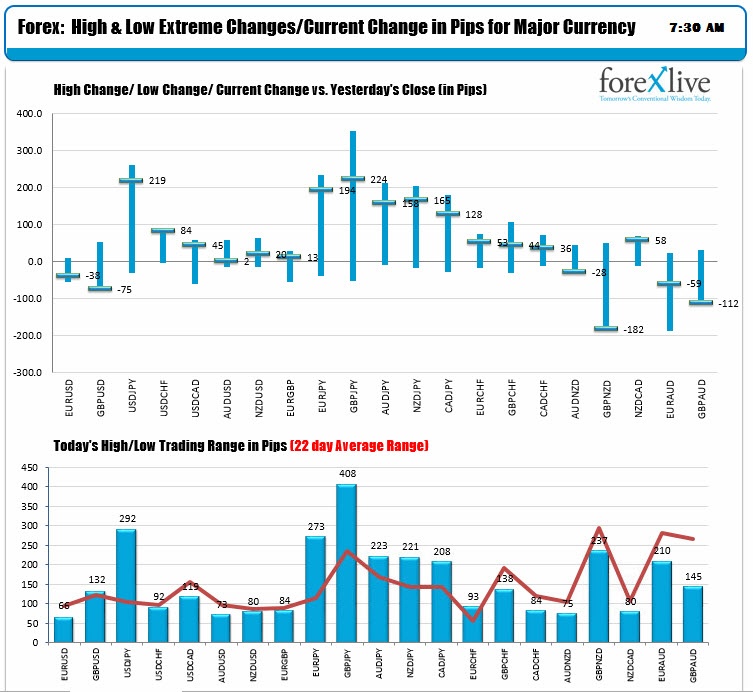

The chart below takes a snapshot of the changes and then the ranges vs the 22-day average range. For the USD, the pairs are mainly near high dollar levels. All the action from a volatility front is in the JPY pair.

Stocks are up up with the S&P pre-opening up about 11 points. European stocks are up. Dax up 0.41% (German retail sales disappointed at -0.2%. EU CPI flash came in +0.4% and 1% YoY). GDP for US and Canada. US goods trade balance is expected come in at -60B. The Chicago purchasing managers index for January is expected to rise to 45.3 from 42.9. University of Michigan sentiment final is expected to dip to 93.0 from 93.3.