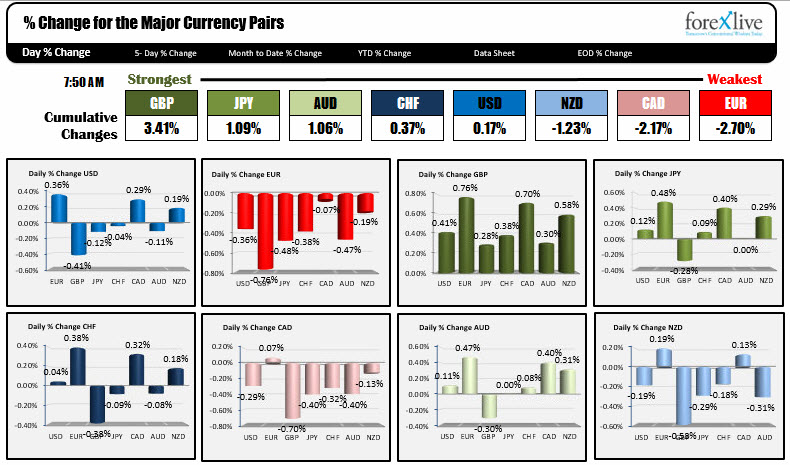

The GBP is the strongest, while the EUR is the weakest.

As North American traders enter for the day, the GBP strongest currency of major currency pairs, while the EUR is the weakest. The GBP has benefited from better-than-expected retail sales (+2.3% vs 1.0% estimate). That news help to send the EURGBP tumbling lower and weaken the EUR in the process.

The USD - after yesterday's fall on the back of the continuation of negative Trump news - is mixed with gains against the EUR ( +0.36%), CAD (+0.29%), and NZD ( +0.19%), but declines against the GBP ( -0.41%), the JPY ( -0.12%), and the AUD (-0.11%). The NZD is near unchanged on the day.

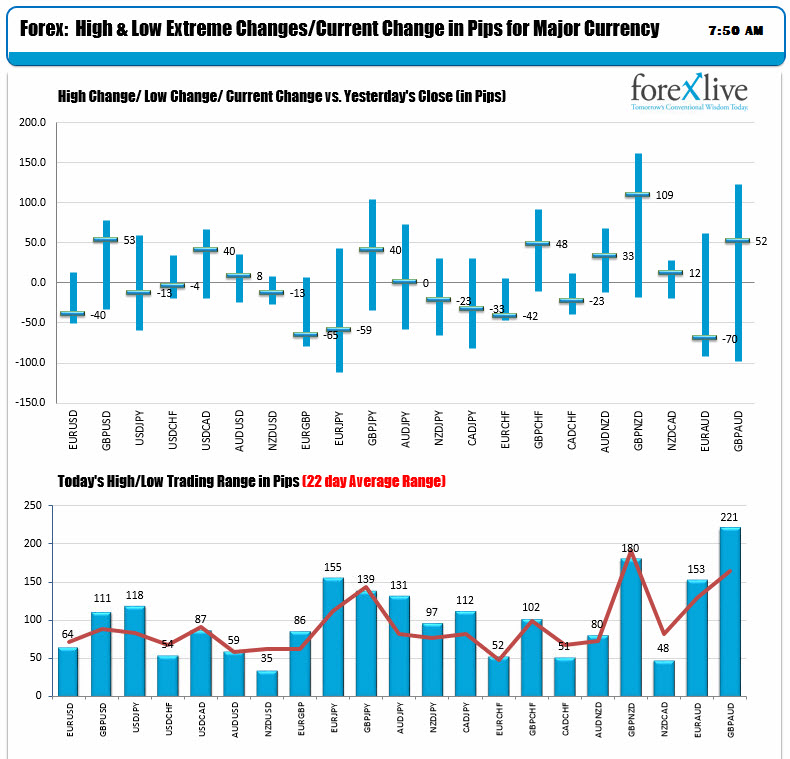

The volatility remains elevated with a number of the currency pairs trading above their 22-day average trading range (about a month of trading). The EUR pairs are also trading near low levels for the day as traders enter in North America.

In other markets:

- US stock index futures are trading lower in premarket trading. The NASDAQ futures are -1.25 ppoints, the S&P futures are down -3.25 points, and Dow futures are dow -45 points.

- US yields are lower again with the two-year at 1.2397%, -0.6 basis points. The five-year yield is at 1.731%, -2.3 basis points. The 10 year is 2.1982%, -2.6 basis points. The 30 year is 2.887%, --2.7 basis points.

- European stocks are lower with the German Dax down -0.73%, the UK FTSE -1.03%, France's CAC down --1.01%, Spain's IBEX --1.64%, and Italy's FTSE MIB --1.60%.

- 10 year yields in Europe are lower as well with Germans 10 year -5.2 basis points to 0.325%, UK -2.8 basis points to 1.04%, France -4.7 basis points to 0.788%, Italy -4.3 basis points to 2.112%, and Spain --3.5 basis points to 1.528%

- Spot gold is trading down -$2 at $1259.58.

- WTI crude futures are trading down -$.58 or -1.18% to $48.49

US initial jobless claims will be released at 8:30 AM with expectations for 240K versus 236K. Continuing claims are expected to come in at 1950K versus 1918K.

The Philadelphia Fed business outlook for May is expected to fall to 18.5 from 22.0.

ECBs Lautenschlaeger speaks in Berli at 8:45 AM/1245 GMT, while ECBs Notwotny speaks in Vienna at 8:50 AM ET/1250 GMT

At 10 AM, US leading index for April is expected to rise by 0.4% versus 0.4% gain in March.