The JPY is the strongest. The GBP is the weakest

As the NA traders enter for trading on Friday, the JPY is the strongest while the GBP is the weakest. The JPY has a safe haven bias after the market digests Trump after his "up and down and all around" presser.

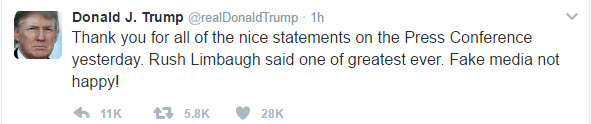

He (and Rush Limbaugh) liked it. The media was not happy (he predicted that in his presser). The rest of the world?

Well, the S&P futures are lower in early trading (down -5.00 points). The Nasdaq futures are down -6.50 and the S&P is down -47. European stocks are lower too with the Dax down -0.38%, CAC, down -0.93% and Spains Ibex -0.81%. The UK FTSE bucked the trend and is up 0.30% despite the bad retail sales report today (-0.3% vs 1.0% est. MoM). The GBP did not like the data as it is lower against all the major currency pairs.

The GBPUSD is lower by about 60 pips today but was down as much as 100. So there is a rebound. That pair fell below the 100 day MA at 1.2419 area but is trading just above that currently.

The GBPJPY is the big mover today, falling by 0.89% in the morning snapshot. It's trading range is well above it's 22- day average today at 232 pips, but after those 232 pips, traders did have the wherewithal to stall the fall against the 200 day MA (green line in the chart below).

Monday is Presidents Day in the US. It is in honor of two US presidents who had birthday's in February - Washington and Lincoln (no DT it is not for you). Add the Friday factor, and the loose cannon in the White House, the action might be a tad volatile as traders square up (just be prepared). Follow technicals for your trading).

Canada Foreign securities purchases are released at 830 AM ET. Last 7.24B.

US leading index for Jan. is expected to rise by 0.5% vs 0.5% last

IN other markets:

- Yields are lower in the US with 2 year down 1.8 bp, 5 year down 3.8 bp, and 10 year yield down 3.9 bp

- Spot gold is up $4.22 and moved above resistance at the 1241.50 area.

- WTI crude is down -$0.27 or -0.50%