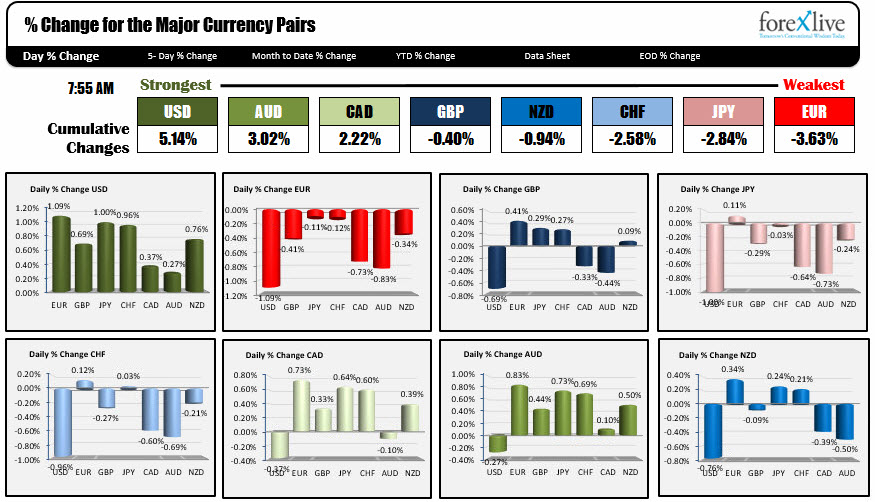

December 15, 2016: The USD is the strongest. The EUR is the weakest.

The USD moved to 14 year highs today the day after the FOMC decision to hike rates and increase the expectations for rate hikes to 3 from 2 in 2017. The USD is the strongest against the EUR (the EUR is down against all the major currencies). It has fallen 1.09% today after declining about 0.70% yesterday. The EURUSD fell below the 2015 low at 1.0462 and triggered stops (now risk). The pair is trading at the lowest level since Jan 2003.

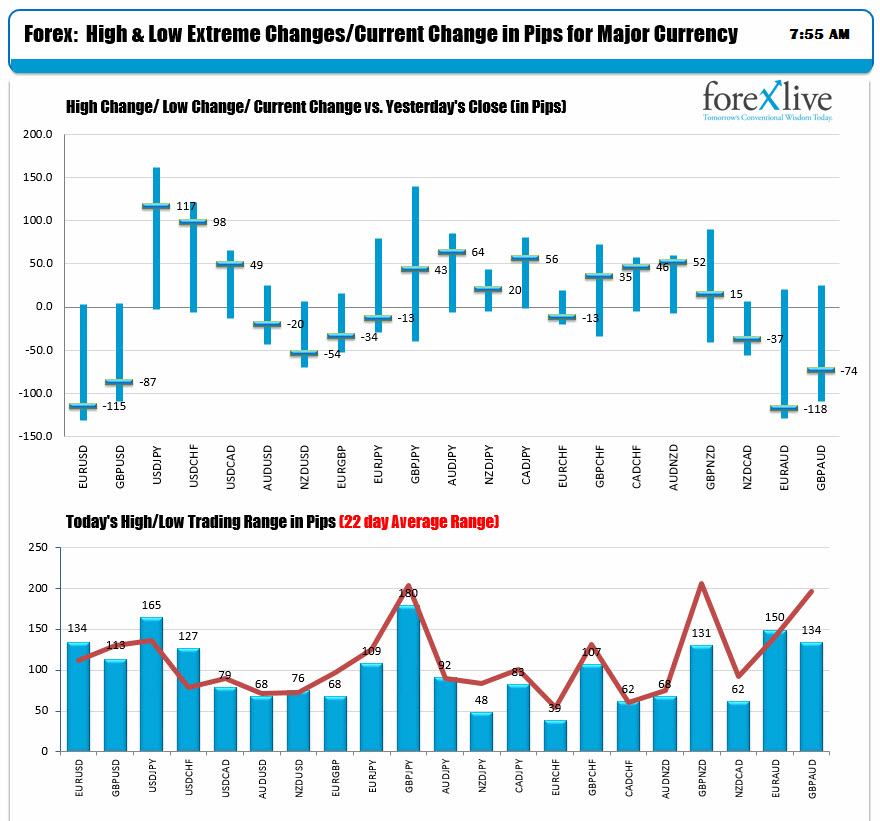

The ranges for the day are showing most of the currency pairs trading near or above the 22-day average range. So volatility remains elevated. The BOE kept rates on hold and said they could go either way. The SNB kept rates unchanged.

I other markets:

- Yields are higher with the US 10 year +5.5 bp, Germany up 7 bp. France up 6 bp

- Stocks in Europe are mostly higher : Dax up +0.4%, Cac +0.62%. The UK FTSE is unchanged

- US pre-opening stocks are lower with

- Crude oil is near unchanged levels at $51

- Spot Gold is down near -$15.00 or another -1.3% on the back of the stronger dollar.

On the calendar:

- US Empire manufacturing 4.0 expected versus 1.5 last

- US CPI month-to-month +0.2%, year on year 1.7%.. X food and energy +0.2% and +2.2% (for YoY)

- US initial jobless claims plus 255K versus plus 258K

- Philadelphia business Outlook 9.1 versus 7.6

- US current account 111.6 B

- Canadian manufacturing sales +0.4% versus +0.3%