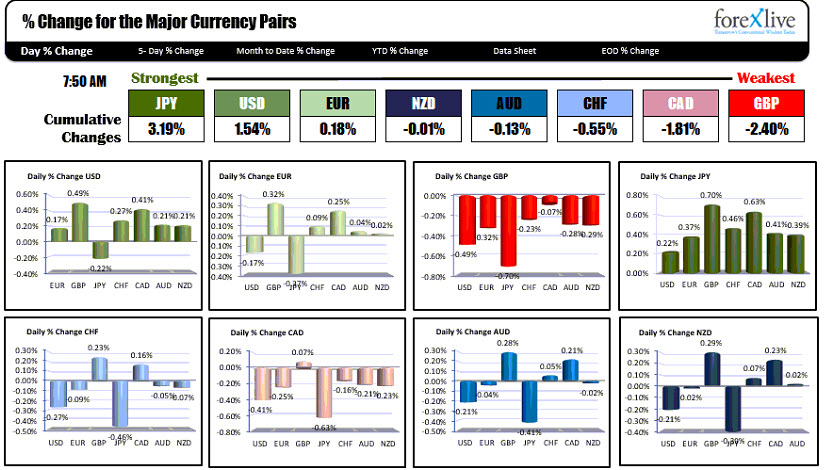

September 16, 2016. The JPY is the strongest. The GBP is the weakest

As the NA traders enter for the day, the landscape shows that the JPY is the strongest while the GBP is the weakest.

Stocks are getting hit with the Dax down -1.35%, while the Euro Stoxx is down -1.24%. Oil i s weaker - down -1.87%. Deutsche Bank is getting hit hard (down 8%) after the Justice Department asked them to pay a $14 B fine for their involvement in the mortgage crisis. That was well above estimates and fines for other institutions. IN the US the S&P futures are down -7.75 in pre-trading. The Nasdaq futures are down -11.75 points. The USD is strongest against the GBP and CAD and is down (weakest) against the JPY and EUR. Mike points to the option expiry in the EURUSD at the 1.1230 area as an influence for price action today. Traders seem to be defending the level so as to benefit from a favorable settlement value. Sellers of options make the maximum profit when the options expire worthless. That happens at the strike price.

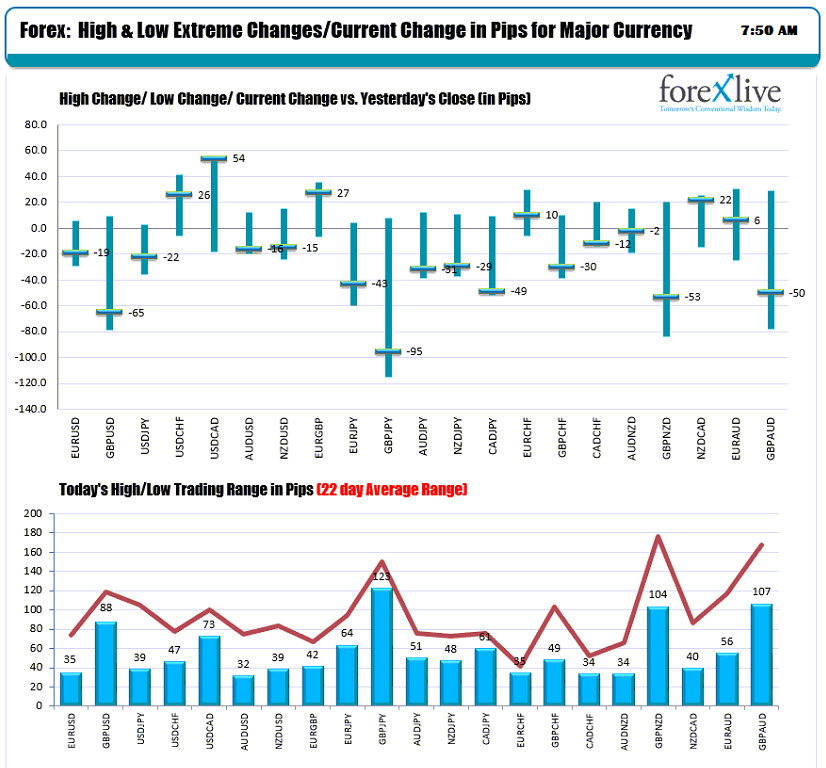

The ranges are lagging the 22-day averages today (see lower chart in the graphs below). with the most focus on the GBP pairs. The CAD is closer to the "red average line" but it too has more work to do. CPI (+0.1% and +0.2% ex food and energy), and Real average earnings in the US, and Cad Manufacturing sales and international securities transactions are due at 8:30 AM ET. At 10 AM the Univ of Michigan preliminary release of their survey will be released for September with the expectations of 90.6 vs 89.8 last.