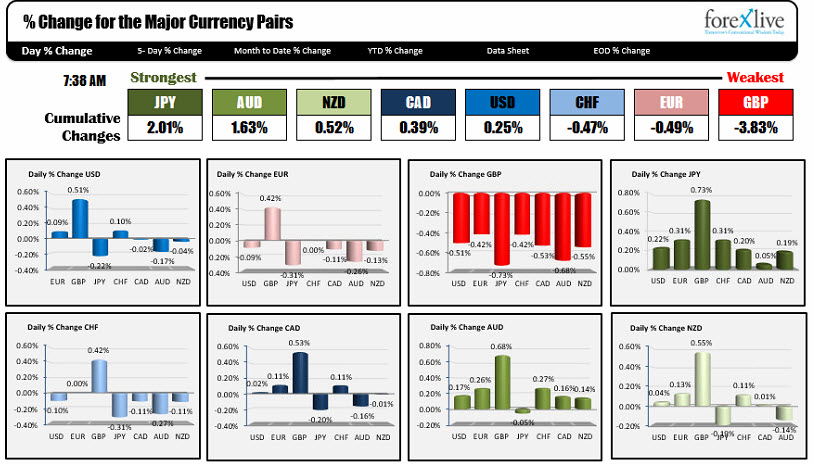

August 9, 2016. The JPY is the strongest. The GBP is the weakest.

The GBPUSD got off to a weak start in the Asia-Pacific session, has had an up-and-down London morning session, and is trading near day low levels. It is helping to contribute to making the GBP the weakest currency of the day as North American traders enter. The strongest currency is the JPY - led by the decline in the GBPJPY. The pair tested the 100 hour MA yesterday but could not muster a close above the key MA level (see prior post here outlining the test).

him and

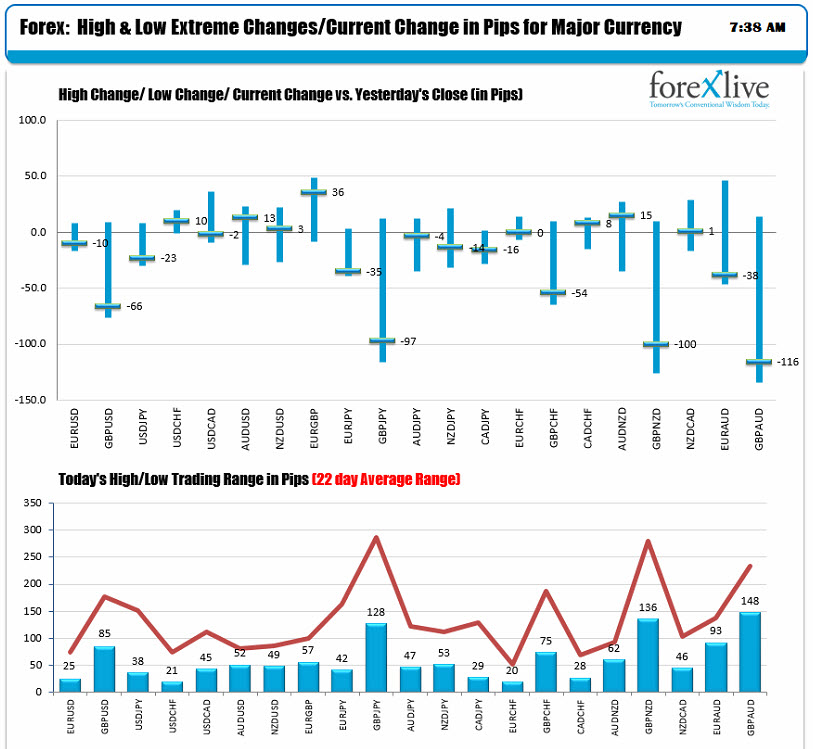

That is the good news. The bad news is the summer doldrums remain. It is most evident in the movement in the EURUSD once again. Yesterday we squeaked out a 33 pip trading range. Today we only have a 26 pip range. That would be a multi year low range if it holds up today. I don't expect that however. Look for value being made below 1.1078 or above 1.1087 for directional clues.

US non farm productivity for the 2Q is due at 8:30 AM ET/1230 GMT with the estimate a t+0.4% vs -0.6% in 1Q. The Unit labor cost is expected to rise by 1.8% vs 4.5% last quarter. At 10 AM Wholesale inventories are expected to remain unchanged at 0.0% for the 2nd consecutive month. Wholesale sales are expected to rise by 0.5%. The IBD/TIPP economic optimism index will also be released (at 10 AM ET/1400 GMT) with the expectation for a rise to 47.3 vs 45.5.