Saudi officials going after banks

Bloomberg reports that Saudi Arabian regulators are probing bank currency trades as the nation's currency peg comes under strain.

The monetary agency is seeking details on banks' forward contracts and warning them about structured products.

"The Saudi Arabia Monetary Agency has asked lenders to explain why they are offering dollar-riyal forward structured products to customers less than four months after the regulator banned options contracts that let speculators place wagers on a currency devaluation, the people said," Bloomberg reports.

Sounds like a bit of a panic move. Riyal 12 month forwards rose 590 points today in the biggest jump since Feb.

The story says the officials want transaction details from all banks on structured product trades dating back to Jan 18.

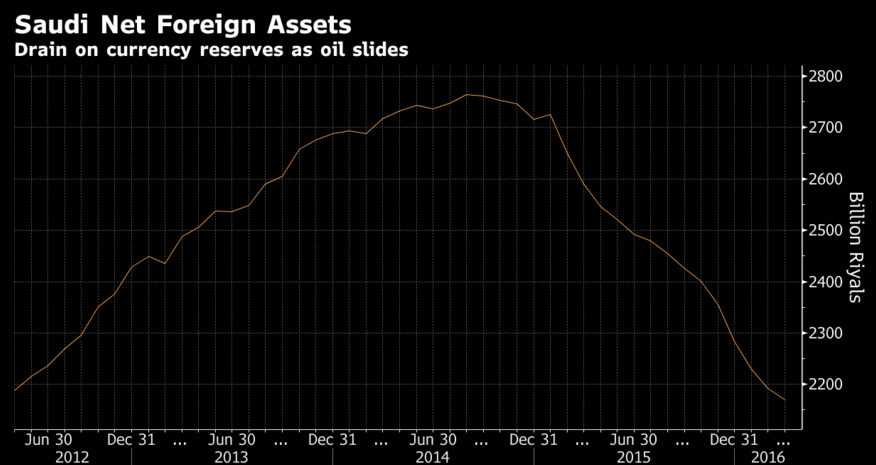

The Saudi Arabian riyal has a hard peg to the US dollar but given that it's a petrocurrency, betting on a break is a big trade and a hedge fund favorite.

Rumors like this can spark a run on a currency as locals buy up US dollars and exacerbate the problem.

Oil impact

The general thinking is that a break would be bad for oil. There would certainly be some domestic turmoil and the reaction may be for Saudi Arabia to shore up government finances buy tapping whatever reserve capacity they have.

The flipside would be that if rising turmoil leads to supply disruptions or a lack of investment but that all seems far off. The Kingdom is still extremely rich.

Another risk is that a run forces Saudi Arabia to sell foreign assets at a faster pace.