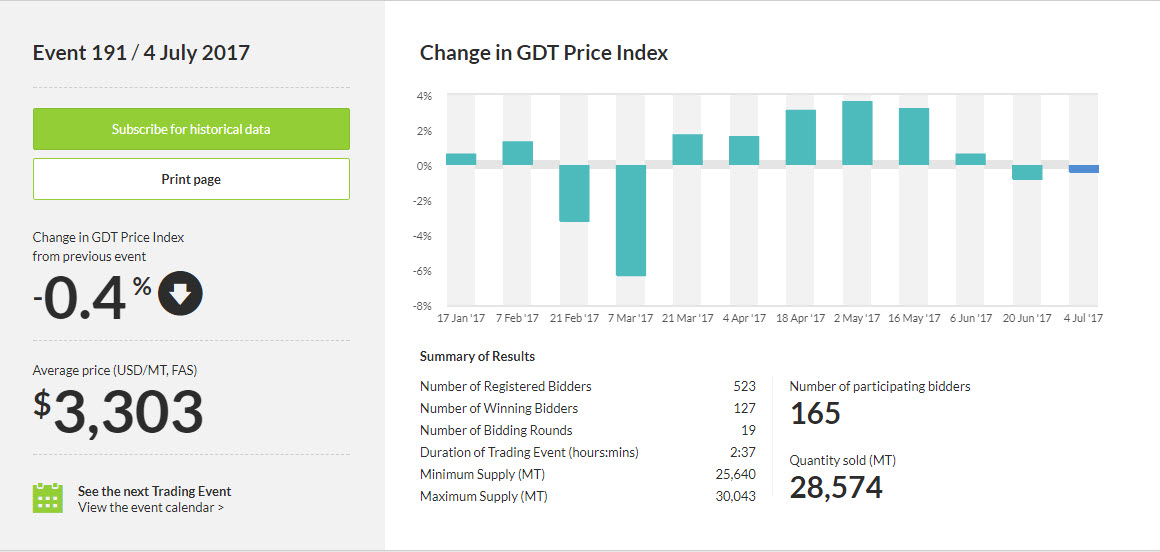

2nd modest weekly decline in a row

The latest GDT auction shows that prices fell -0.4%. This is the 2nd consecutive modest weekly decline after 6 straight increases. The average selling price came in at NZ$3303.

The NZDUSD is little changed after the report.

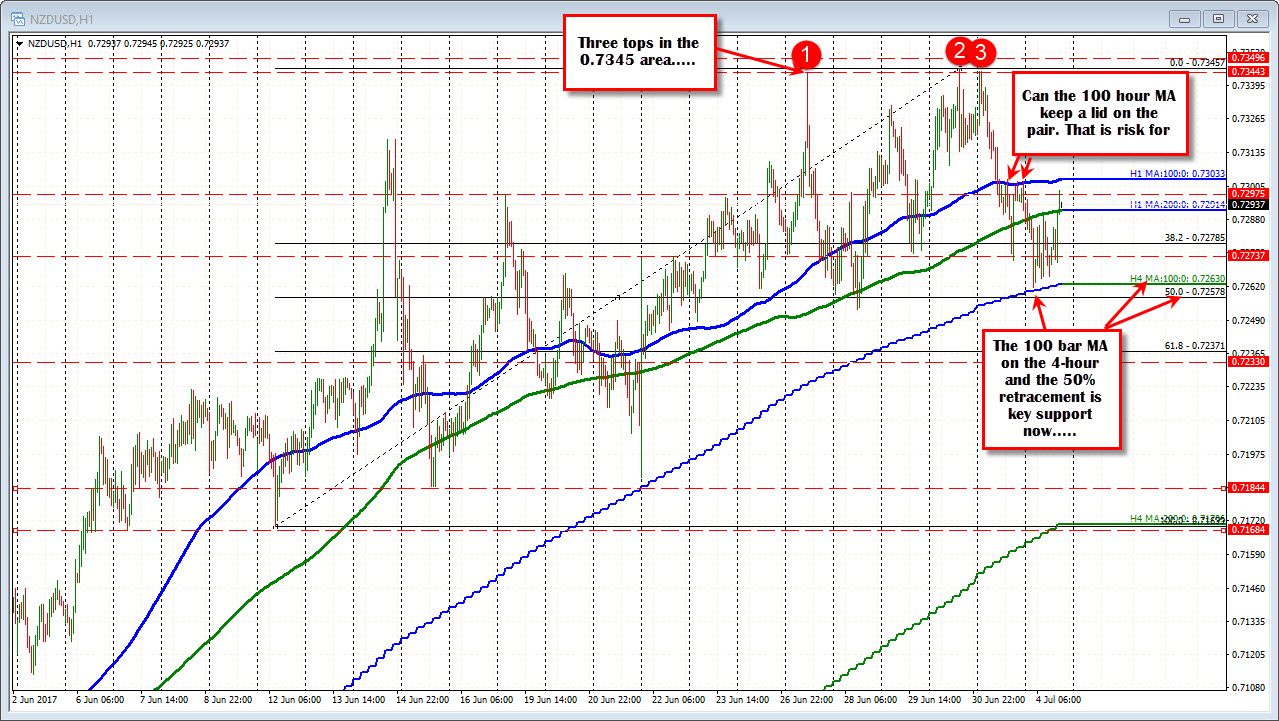

Looking at the hourly chart of the NZDUSD, the highs from last week and again yesterday stalled at the 0.7445 area. The price fell below the 100 hour MA at 0.7303 yesterday and stayed below since that time. The low today fell to the 100 bar MA on the 4-hour chart at 0.7263 and rebounded back toward the 100 hour MA at 0.7303.

The fall in GDT prices should keep a lid on the pair against the 100 hour MA level (at 0.7303) with stops on a move above the level. On the downside, a move below the 100 bar MA on the 4-hour chart at 0.7263 and the 50% of the move up from the June 12 low at 0.72578, are key levels to get below IF the sellers are to take more control. That MA line has held support today and also held support back on June 22.