Reverses Friday's fall

Overall, the CAD is the strongest currency today - rising against all the major currencies. Of the pairs, the CADJPY is the biggest mover on the day. The pair is up 1.59% on the day. The pair has been helped by higher oil prices and a firmer JPY on rising stocks and a technical break back about 100 day MA (see post here)

What does the CADJPY look like technically?

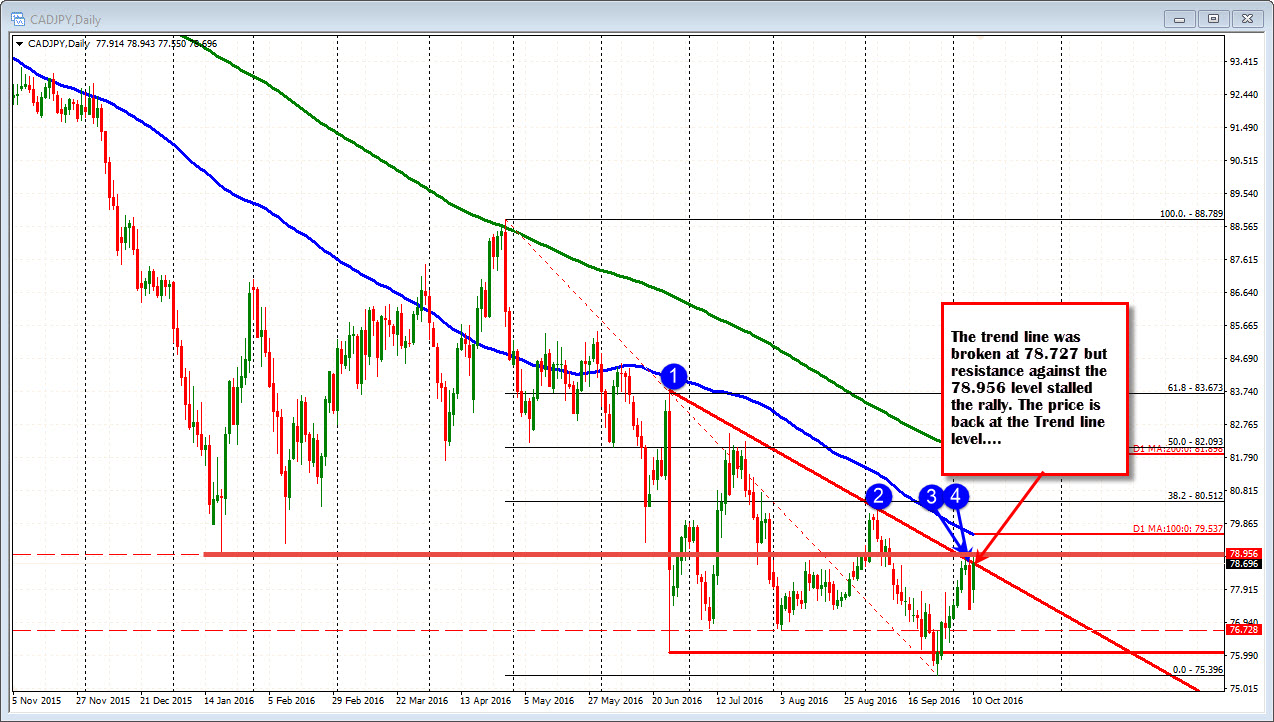

A multi year low in the pair was made on September 27 at 75.396. The price had not traded that low since June 2012.

However, since that low, the price has rebounded higher. On Thursday and Friday of last week, the price tested a trend line resistance level (see chart above). Despite the better-than-expected Canadian employment data on Friday, the pair moved back lower. Was it technical traders leaning against the trend line? All of the other CAD pairs had a similar bearish bias.

Today however,, we are seeing a push back higher.

Technically, the aforementioned trend line cuts across at 78.727. The high price traded above that level but we are currently trading back at the level. The high reached 78.94 which was just short of the swing low going back to January 19th. Admittedly, the price has traded above and below that level over the last 3+ months of trading. Nevertheless, the low from January still sticks out. The 100 day MA looms ahead at the 79.537 level. There has not been a close above the 100 day MA since May 31, 2016. Needless, to say as we head into a new trading day, if there is more upside potential in this pair, it would have get and stay above levels like the 78.956 and the 100 day MA at 79.537. That in turn will probably take some further upside in the USDJPY and oil prices?

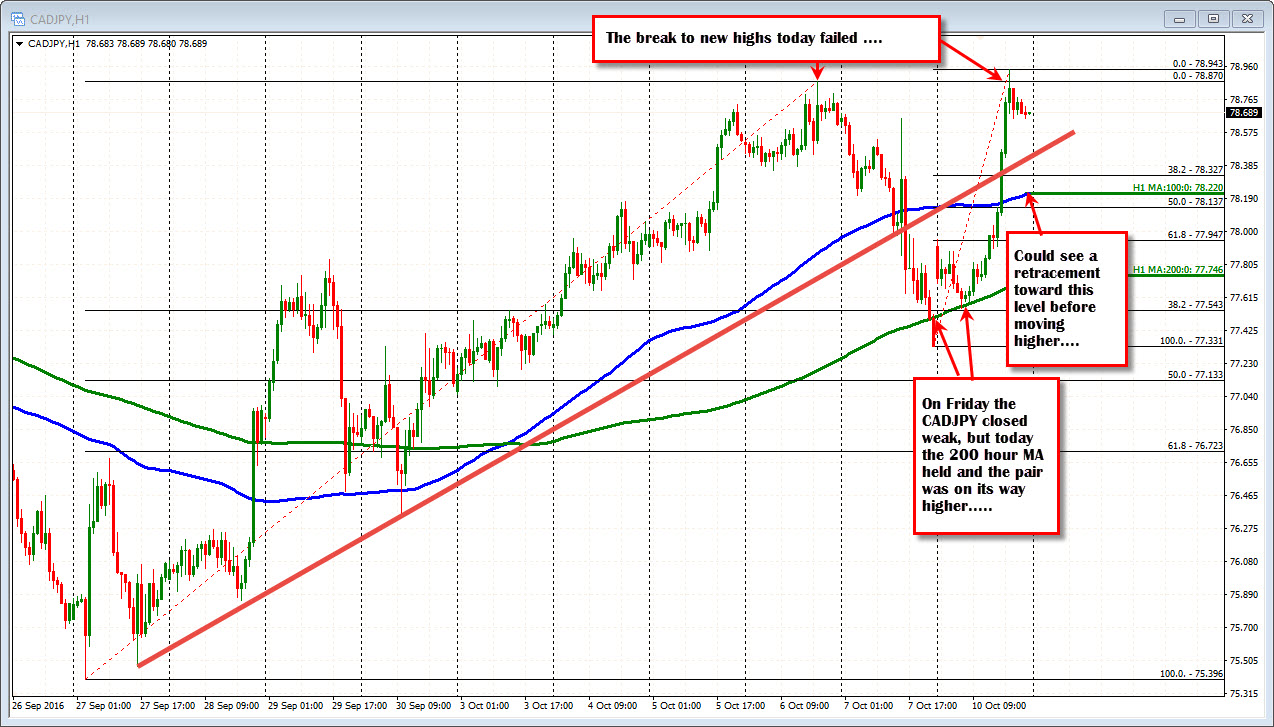

Drilling down into the hourly chart (see chart below), the bulls should like he failure of the break below the 200 hour MA on the Friday close. They should also like the break and holding of the 200 hour MA today. The break above the 100 hour MA was pretty convincing as well.

What is not so great is that the high from last week was taken out at 78.87 (high reached 78.94), but that break failed. That corresponded with the break of the trend line on the daily chart. HMMMM. Not so bullish.

So the best pair of the day today was the CADJPY, but the price strength has taken the pair right to resistance. If the CADJPY is to go higher, it will need to find the push that will take the price to - and through - that overhead resistance. If it cannot - and right now it seems that way - we should see a rotation back toward the 100 hour moving average at 78.22. I would expect to see buyers show up there and gather some momentum for a break and run above that key overhead resistance.