Morgan Stanley with Elliot Wave analysis, starting at the big picture and down to a lower time frame

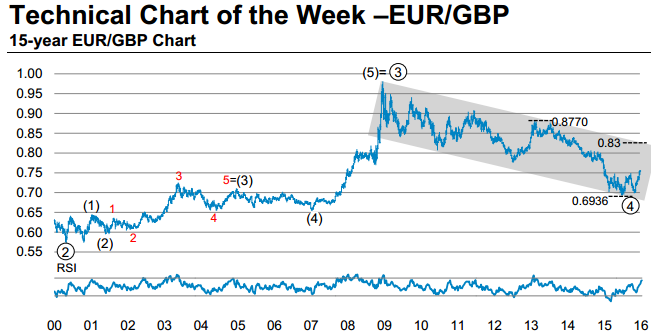

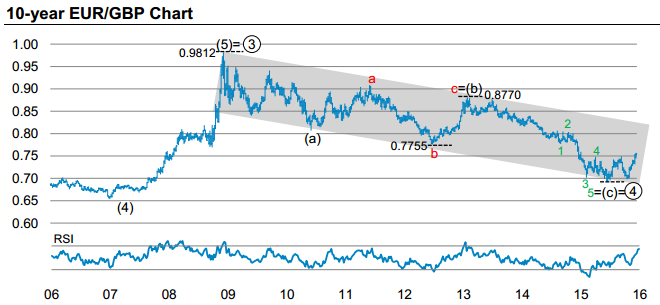

The technical and fundamental picture suggests further upside for EUR/GBP. Having completed the 4th wave with a low at 0.6936, we believe that EURGBP's 5th wave would initially head towards the top end of the channel at 0.83. If our 5-wave analysis is correct then EURGBP would eventually trade above the 3 -wave top at 0.9812, a multi-year target.

The 4th wave downtrend has formed a sub (a)-(b)-(c) structure. The most recent (c)-wave completed a 5-wave sequence at the low of 0.6936 in July. A retracement of the 3rd wave targets 0.8035 (38.2% retracement) and then 0.8714 (the 61.8% retracement level).

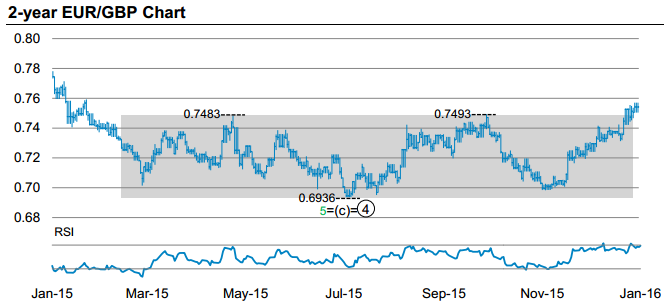

EURGBP was trading within a range since February 2015 with the break out at around 0.75 suggesting there is further upside momentum for the pair. We recommend buying EURGBP and target 0.80. The downside momentum is also building for GBPUSD, which was our technical chart last week.

-

From MS technical analyst Sheena Shah

-

One for the Elliot Wavers - comments welcome.