The WSJ is exploring quant funds

The Wall Street Journal is in the midst of a 17-part series that looks at the rise of quant funds.

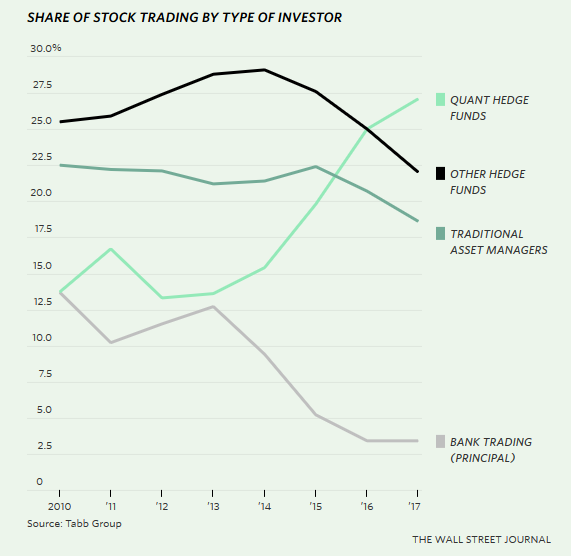

The AUM and money invested in quant funds still trails traditional asset managers but the gap is closing.

What's truly amazing is volume. Quant funds make up 27% of trading volume in US stocks, up from 14% in 2014. That means there's a better than one-in-four chance the other side of your trade is a computer.

Here's what the WSJ promises to unveil in the coming week:

But what happens when too many quants use the same inputs and formulas?

Will the market fall in lockstep, pulling every asset lower?

And if everyone in the market is eventually a quant, what advantage does that really confer?

In our series "The Quants," The WSJ explores just how far this approach has changed the nature of investing-and where it will evolve next.