Tuesday at 09.30 GMT we'll see the latest UK inflation data

Last Thursday the Bank of England were in more hawkish mode with Forbes voting for a hike and others suggesting that one was becoming more justified.

Tomorrow's UK inflation data will be keenly awaited. If it comes in under expectations then we'll see some GBP losses again but similarly a stronger reading will sustain recent gains given the BOE's inflation-dependent blinkered stance right now. Ignoring sluggish wage growth and rising household debt is dangerous though imho.

I was travelling as the news came out and was frankly surprised by the MPC's generally bullish tones for hikes even as they're admitting:

"The Committee expects a slowdown in aggregate demand over the course of this year, as household demand growth declines in reaction to lower real income growth. Official estimates of retail sales have weakened notably, consistent with this expectation."

There's little doubt that their focus is all about inflation and fears that it may run away higher and a little more quickly than they first expected.

"As the Committee has previously noted, there are limits to the extent that above-target inflation can be tolerated. The continuing suitability of the current policy stance depends on the trade-off between above-target inflation and slack in the economy. The projections described in the February Inflation Report depend in good part on three main judgements: that the lower level of sterling continues to boost consumer prices broadly as expected, and without adverse consequences for expectations of inflation further ahead; that regular pay growth does indeed remain modest, consistent with the Committee's updated assessment of the remaining degree of slack in the labour market; and that the hitherto resilient rates of household spending growth slow as real income gains weaken, without a sufficient offset by other components of demand"

I stand by my view that UK rate hikes will not be happening anytime soon regardless of these more hawkish tones. I've flown in the face of this scenario before and been proven right and was also justified by my call on FOMC rhetoric last week.

In general central banks seems to be more reliant on market sentiment now than setting policy as they see fit/appropriate according to economic conditions. I don't think that's a particularly healthy state of affairs but it is what it is, albeit making an independent BOE less relevant/useful.

So attention turns to the data tomorrow and no doubt the BOE will be looking to see what reaction the markets offer. A case of one second-guessing the other. Is it any wonder we currently see a ball of confusion when you throw in Brexit for good measure too. By coincidence BOE gov Carney is due to step up to the rostrum just after at 10.00 GMT

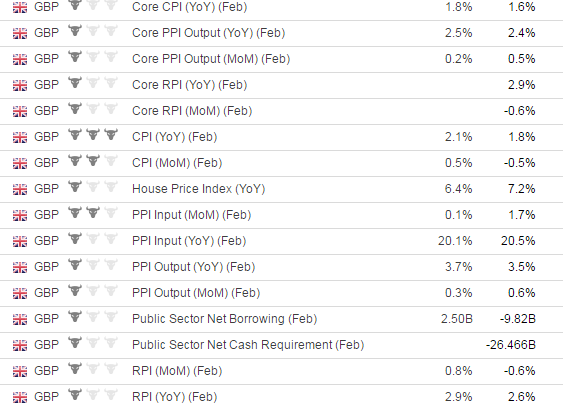

Here's the forecasts:

Not that the headline CPI rate will this month become CPIH and will include the price of housing rentals and local tax among other changes so a like for like comparison will not be quite so straightforward.

In simple terms softer data will see GBP lose some of its post BOE gains while stronger than expected will only increase the hike hype and put a bid under the pound again.

Currently GBP pairs in retreat again on yet another Brexit wobble (justified or not) so we're reminded that inflation and the BOE aren't the only game in town right now, or indeed the foreseeable future, in this increasingly fickle world of forex.

GBPUSD now 1.2384 having posted session/recent lows of 1.2367 after earlier highs of 1.2436. EURGBP 0.8682 having once again failed at 0.8690.

The jury remains well and truly out but I know which side I'll continue to back.

BOE's Carney - Watching and waiting