Comments from the SNB leader Thomas Jordan:

- CHF still significantly overvalued despite euro and USD gains

- Policy of negative rates and FX intervention helping to stabilize prices

- ECB monetary policy is particularly relevant for Switzerland

- Continues to take account of exchange rates situation in setting monetary policy

- Monetary policy alone cannot remedy all ill, especially structural ones

- Will continue to make the most of Switzerland's monetary policy latitude to respond pragmatically to challenges

He's a bit more open than usual talking about FX intervention here but generally these are the same comments we've heard many times before.

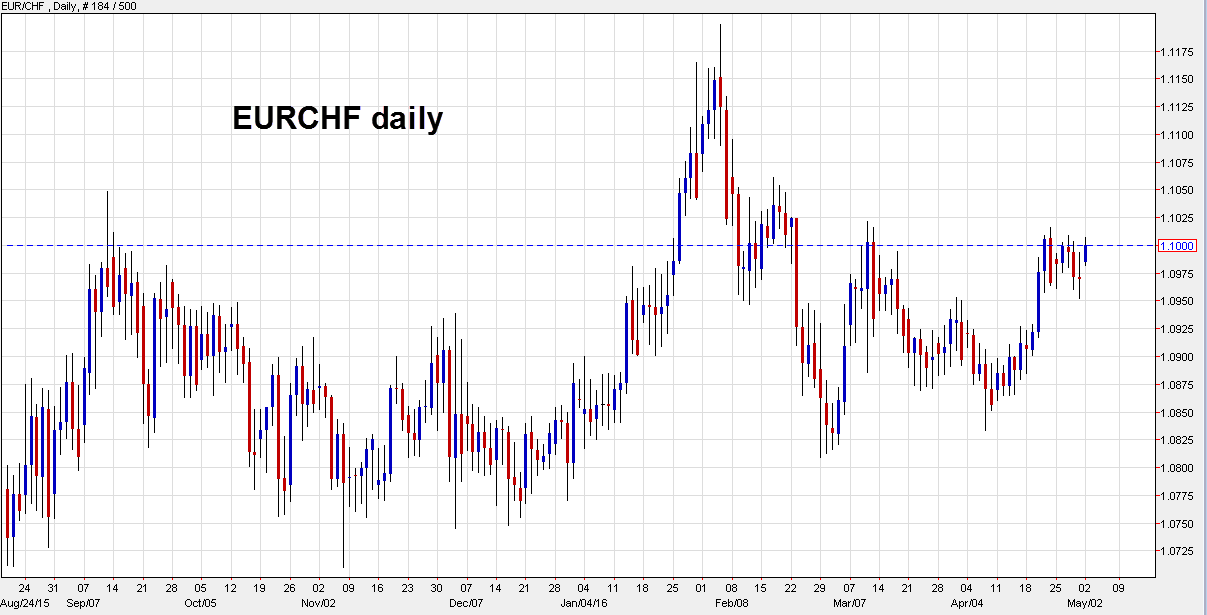

EUR/CHF is near the March-April highs but still a long way from the 120+ where Jordan would like it to be.