Too much transparency is working against the SNB

EUR/CHF has gained this week but it's still far below where the Swiss National Bank thinks it should be as they fight a recession and disinflation.

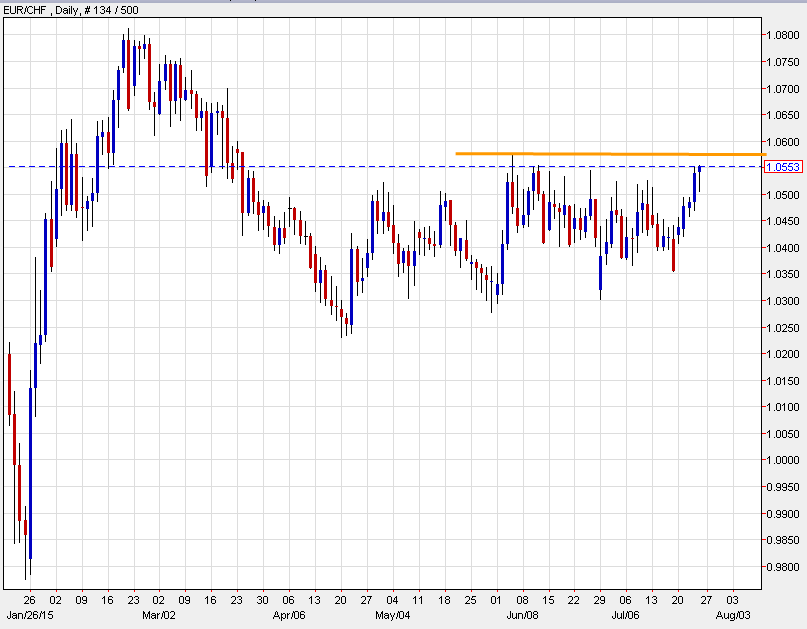

EUR/CHF has made another quick, somewhat mysterious move higher today in the past hour, rising to 1.0552 from 1.0514. The June high of 1.0573 is resistance.

EURCHF daily

Julius Baer Group Chief Economist Janwillem Acket argues today that by publishing weekly sight deposits, the SNB is telling the market too much. A more-mysterious SNB is a fresh option for a central bank that appears out of ideas.

He also argues that using a basket of currencies, rather than the euro would allow them more flexibility. He points to Singapore as a successful example.

Bloomberg writes about it today. "Singapore's model -- with an undisclosed basket, no accounts of meetings and few media interviews -- discloses only very little information," the report says.

Realistically, it seems highly unlikely with people and the government in Switzerland pushing for more transparency. But it's a lesson to other central banks when the next round of currency wars intensifies.