Fed paper completely misses the point

Researchers at the New York Fed released a paper today that congratulates the FOMC for not hiking rates and 'proves' how that wise decision added a full percentage point to growth.

But the paper only proves two things, none of them relevant to the US economy:

- Mindless wonks who lack any kind of intellectual creativity think they can model everything. And they have all the power in economic circles.

- Kissing ass is still the easiest way to get to high places

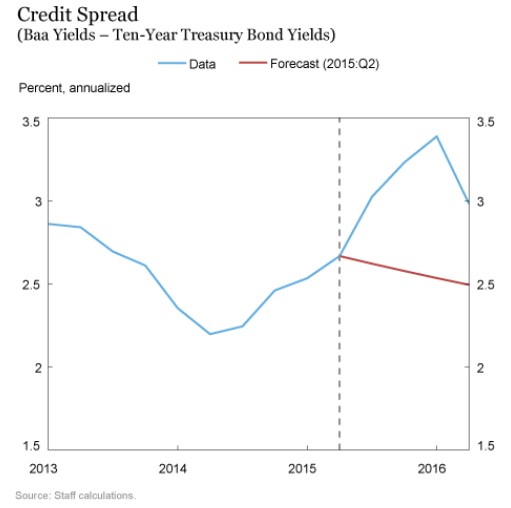

The paper starts out well enough. It aims to show the effect of rising credit spreads on growth. A great little chart shows the jump in spreads.

The problem is that credit spreads rising are an effect of economic disruption, not usually the cause.

Here's where it gets bad

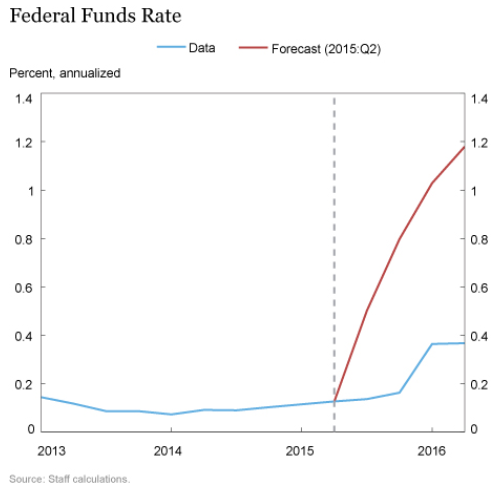

The researchers cherry pick hard on what was expected from the Fed.

Instead of using what markets were expecting, they use the dot plot to signify the forecast for the Fed funds rate.

Then when the Fed didn't follow their own dot plot, they congratulate the FOMC for the foresight; as if they had bent the will of markets.

In reality, it was the opposite. Markets never bought into the dot plot and it was the Fed that needlessly tried to drive up rate hike expectations only to be reeled in by lackluster growth, which markets anticipated the whole time.

So the numbers fall apart. If you say 100 basis points of easing was expected and then take it away, the Fed looks heroic. The thing is, that was never expected. Midway through Q2 of 2015, the Fed funds futures market was pricing only a 66% probability of a hike by year end. If anything, the Fed proved to be more hawkish than was expected.

A better conclusion of the paper would have been: If the Fed had followed its own terrible dot plot forecasts, growth would be 1 percentage point lower.

Ok, back to the credit spreads. Why did they widen? The collapse in resource prices. Why did spreads recover? The rebound in resource prices.

Hopeless.