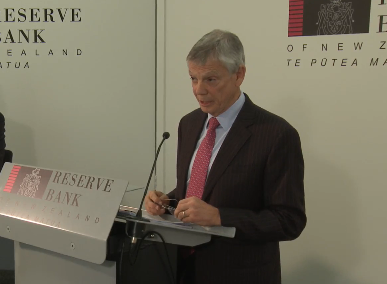

Wheeler in the press conference after his statement

- Inflation expectations seem to have stabilized

- Not much has changed since our previous OCR decision

- One further cut is built into our interest rate projections, but that could change

- You could end up with no cut or more cuts

- The economy is likely growing 2.5-3.0%

- Could put in macroprudential housing rules before year end, studying now

- Falling inflation expectations were a major reason why we cut in March, those have stabilized

- We felt at this stage that we don't need further monetary stimulus for the economy

- Output gap is basically closed now

- I don't want to give the impression that these decisions are driven by financial stability

- Young people think house prices will continue to go up

- We want to see house-price inflation slow significantly

- Daily turnover in NZD is approx. $1.05B per day

- We have a limited ability to influence currency

- Our rate decisions will be based on inflation (not NZD directly)

The market is pricing in a 60% chance of an August cut but that's sounding way too high. Wheeler sounds like he's leaning towards staying on the sidelines.

Assistant Governor McDermott is taking some questions too:

- We will have new inflation at the August meeting, when the picture will be much clearer

- We will be looking at consequences of high NZD on economy