Speech from Luci Ellis, Head of Financial Stability Department at the Reserve Bank of Australia

text: Property Markets and Financial Stability: What We Know So Far

Not much in the way of headlines from her speech crossing the wires ...

Bloomberg have: "Must not forget costs of financial instability"

-

I don't want to summarise the whole of her speech in a paragraph and a graph, its more nuanced than that .... but ... that's what I'm gonna do.

She doesn't seem that concerned by the surge in house prices and housing lending:

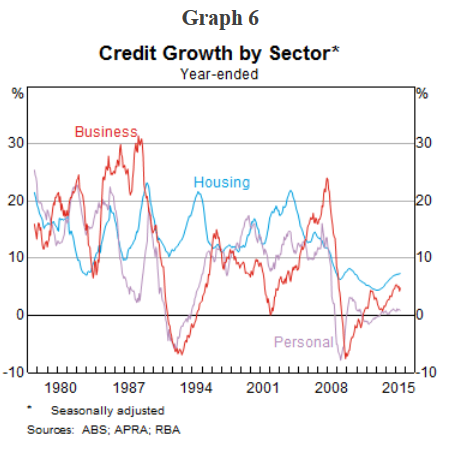

And if we are looking for surges in credit growth as precursors to painful downturns, we should bear in mind that, historically, these surges have been evident in business credit far more than in housing credit. That is certainly what we see in the Australian data (Graph 6).

My takeaway is that the danger of rate hikes from the RBA in response to surging house prices and the growth in housing credit is not close. The bank will be watching business credit growth more so than housing credit growth. Thats it in a nutshell, but more detail at the speech (link above)