Antony Barton at LiveSquawk has posted up his excellent RBA preview for LiveSquawk subscribers

Don't anyone tell him, but I've stolen it (ps, you can access all of LiveSquawks excellent coverage like this - much more than just Squawk - by subscribing. they've got a free trial available if you want to try it out. Tell 'em Eamonn sent you :-D )

| PREVIEW | ||

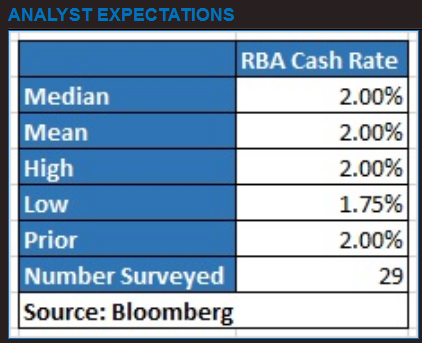

Expectations are for the Reserve Bank of Australia (RBA) to stand pat and leave its benchmark interest rate at 2.00%, with only 1 of the 29 surveyed by Bloomberg looking for a cut. The question seems to be how will the board view the global market volatility and the lower exchange rate that have come into play since the turn of the year. TD Securities note that "up until now the RBA's language has been upbeat, the Bank showing it has little appetite to entertain a rate cut anytime soon. Indeed data out over the holiday period showed retail sales are at record highs in nominal terms, employment growth reached 3% and Chinese imports are at a record highs. On inflation, it was bang on the Bank's Nov SoMP forecasts at 2%. There are tentative signs too of exchange rate pass through which will please the RBA. However offshore developments pose a clear challenge to the RBA's optimism and we expect the Bank, like the RBNZ and Fed, to play it with a straight bat. The Bank will make it clear that downside risks from this front have increased. This will reinforce the Bank's easing bias. Also what the Bank says on future Fed hikes will be worth monitoring too." In terms of the domestic currency the RBA has to deal with the fact that Australian sovereign yields have become even more attractive after the BoJ's surprise easing, which could see carry trades supporting the Aussie, preventing the fall the central bank so desperately wants. Looking ahead Capital Economics believe that "if GDP growth comes in weaker than the RBA expects, as we believe, and underlying inflation fails to pick up at the speed the Bank hopes, then the RBA will have no choice but to cut rates again this year." HSBC's Paul Bloxham is of the belief that "the RBA has been comforted by recent strong jobs growth and business conditions. However, inflation is low and forecast to stay subdued, leaving the RBA with scope to cut further in 2016." Although consensus is for further easing in 2016 (with a November cut fully priced into the OIS curve) some noted analysts are wary of the fact that such a move may not materialise. Bank of America say that "despite market pricing of further RBA easing, we expect the central bank to stay comfortably on hold over 2016". The RBA will be able to elaborate on its thought process when it releases its quarterly Statement on Monetary policy (SoMP) later in the week. The last SoMP saw the central bank slash near-term underlying CPI to 2.0% from 2.5% and that materialised in the Q4 print, but this did not give grounds for a cut in either November or December. With lower oil TD Securities "expect a boost to GDP and potentially less of a pickup in underlying inflation by year end. Nothing there to trigger a cut, just voice the easing bias while underlying inflation rests on the lower 2% band for now." |

ps.

My preview is here:

- RBA decision & statement today. But the most important AUD clue will be missing.

And earlier ones here:

- Australia - Preview of the RBA monetary policy meeting Tuesday 2 February 2016

- RBA meets February 2, preview of what's expected