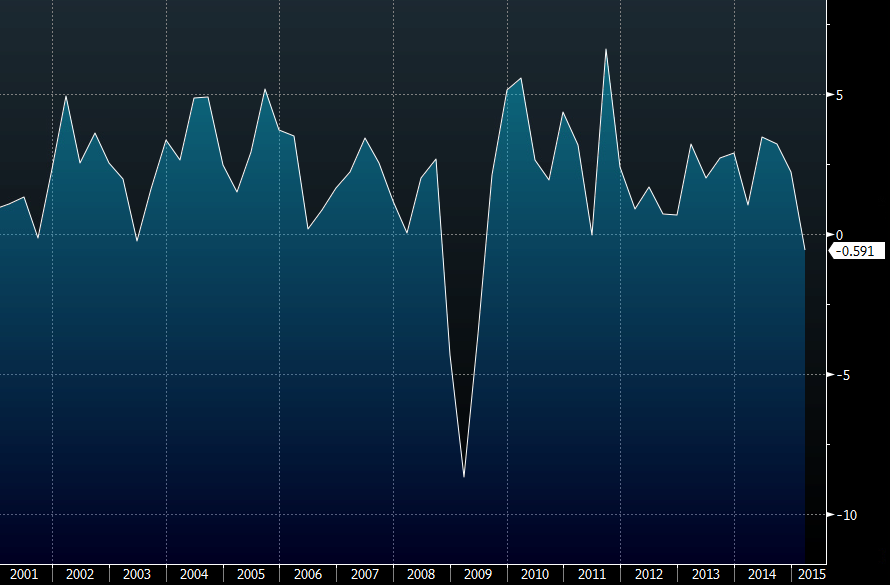

Canadian GDP headed for second consecutive quarterly contraction

Canada second quarter GDP is due out at the bottom of the hour and expected to show a 1.0% annualized contraction. That follows a 0.6% decline in Q1.

The report takes on extra-special significance ahead of Canada's October 19 election. PM Harper has already been downplaying recession talk, saying it's confined to the oil sector but he's behind in the polls.

For FX traders, the loonie is the big story. USD/CAD barely dipped despite a 27% rebound in oil prices in the past week. Now, with crude down 3.2% and Canada facing recession, USD/CAD is finding it much easier on the upside. The pair is up 64 pips to 1.3214.

The European high of 1.3233 is resistance. If it breaks on a weak report, look for a relatively quick move up to Monday's high of 1.3320.

Note that the RBC Canadian manufacturing PMI is due at the same time. Prior was 50.8.