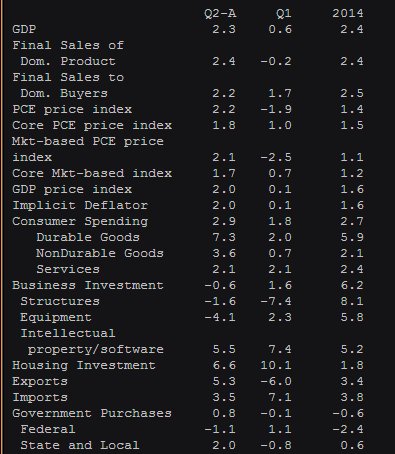

Q2 2015 US GDP flash data report 30 July 2015

- Q1 final -0.2%. Revised to +0.6%

- Personal consumption 2.9% vs 2.7% exp. Prior 2.1%. Revised to 1.8%

- PCE 2.2% vs 2.0% exp. Prior -2.2%. Revised to -1.9%

- Core PCE 1.8% vs 1.6% exp. Prior 0.8%. Revised to 1.0%

- Exports 5.3% vs -6.0% prior

- Imports 3.5% v s7.1% prior

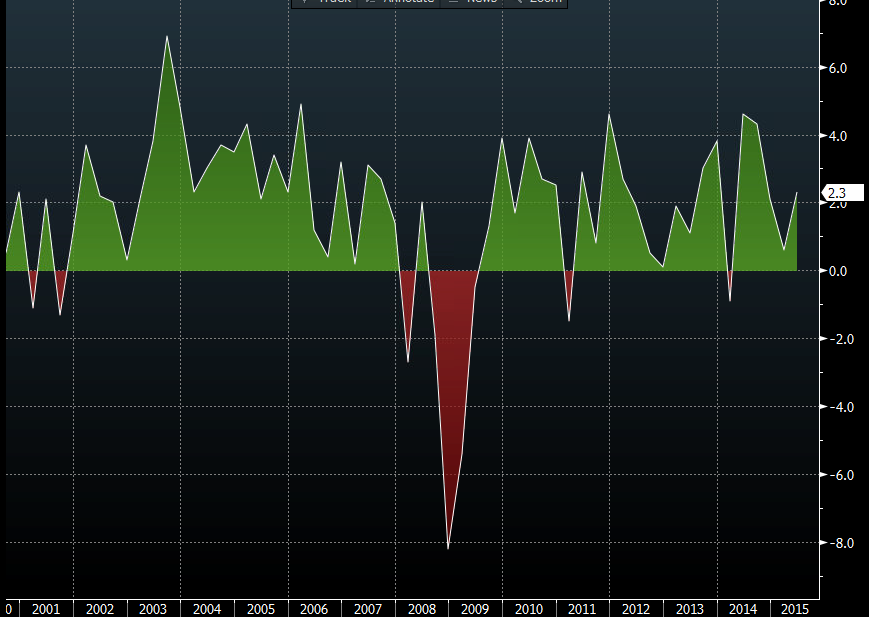

On a quick look we're doing ok. 2.3% is around the ball park which reduces worries that Q2 would follow in the footsteps of Q1

USDJPY has been to 124.30 and 124.54, and sits right back where it started at 124.40

Perhaps the biggest positive is the consumption numbers that beat expectations, although Q1 was revised down. The laggard to the economy and the rate of jobs growth has been consumer. The PCE numbers will give a boost to inflation watchers but they have swung wildly from Q1

Not bad numbers from the trade point of view with exports jumping to 5.3%

US Q2 2015 GDP y/y ann

The revisions aren't anything to write home about. 2014 GDP remains unrevised at 2.4% and core PCE is revised up to 1.5% from 1.4%. It's all old news though so there's not much attention being paid to it by the market