Here's the ...er second only US NFP preview post you'll need today

Time to grab some price levels to watch over NFP.

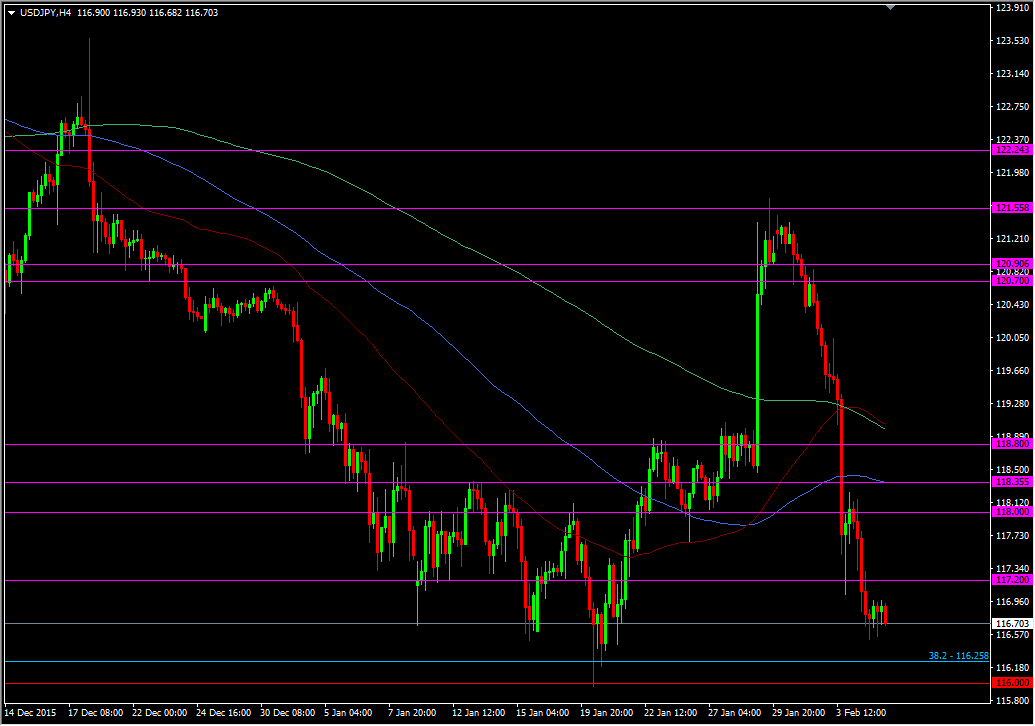

USDJPY

UP

- 117.00 has been border patrol since late in the European day yesterday. It's too close to the current price to have any effect but let's see where we are come the release.

- 117.20 has had it's moments through Jan and way back the end of 2014 and early 2015

- 117.60/70 could hold some mild resistance as it staked a spot on the big move down on Wednesday.

- 118.00 likewise made itself resistance after a bit of indecision around the big figure

- 118.20/25 looked to be protecting the break through 118.35 and the 100 H4 ma sits right at 118.35 also.

- My old mate at 118.80 was carved open very easily on the way down but I would expect it to put up a better fight if we have a move back up. If anything, I'd be looking to see some resistance around the 118.50/60 area first.

- 119.00 I think would be the very farthest stretch point I'd look at but I think it would need every item on the jobs report to be super good to get there.

USDJPY H4 Chart

Down

- The intraday lows at 116.50 can also be marked back a couple of points in mid-Jan down to 116.45. Again, too close for comfort but an area to watch if we see any rally faded or reversed.

- There looks to be protection of 116.00 around 116.20 but a bad number will probably push through that. 116.00 is the more important number today as a break there could bring some real trouble.

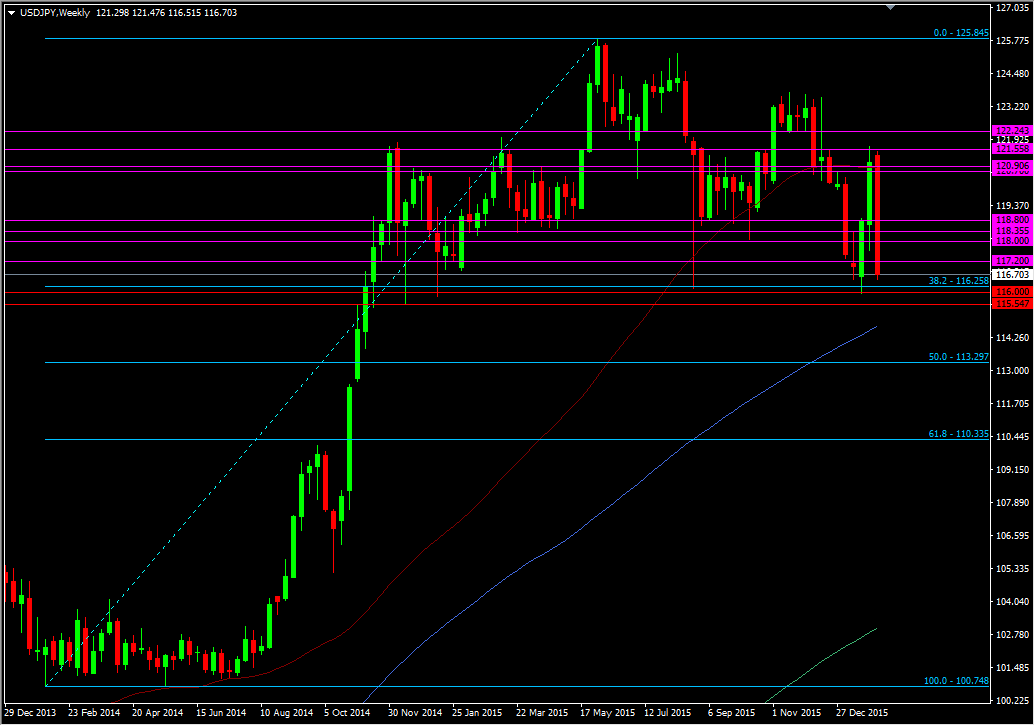

- We could see support around 115.80 but I'd be worried that a blow through 116.00 would have enough in the tank to ignore it, and 115.50/55 would be the first point that we might see a pause.

- Go through there and 115.00 could be seen fairly swiftly and some minor looking support at 114.80, and stronger via the 100 WMA at 114.69, that could well mark the edge of any big move south.

USDJPY Weekly chart

I think the greater risk for today is to the downside. USDJPY just can't find it's feet and rallies are being swiftly sold. My ideal trade today would be to sell any half decent bounce on a flat to mildly good report. If we got a good 50+ pip rally, or a move to one of the levels above I'd be inclined to sell it and see what the rest of the afternoon brings.