April expected to be strong month for US retail sales

The highlight on the US economic calendar this week is the April retail sales report. The numbers are due at 8:30 am ET on Thursday (1230 GMT).

The consumer is another part of the US economy that has disappointed so far this year. The Federal Reserve believes that solid jobs growth means that it's only a matter of time until consumers begin to spend.

The problem is that jobs gained doesn't always mean good jobs gained and consumers are struggling with debt.

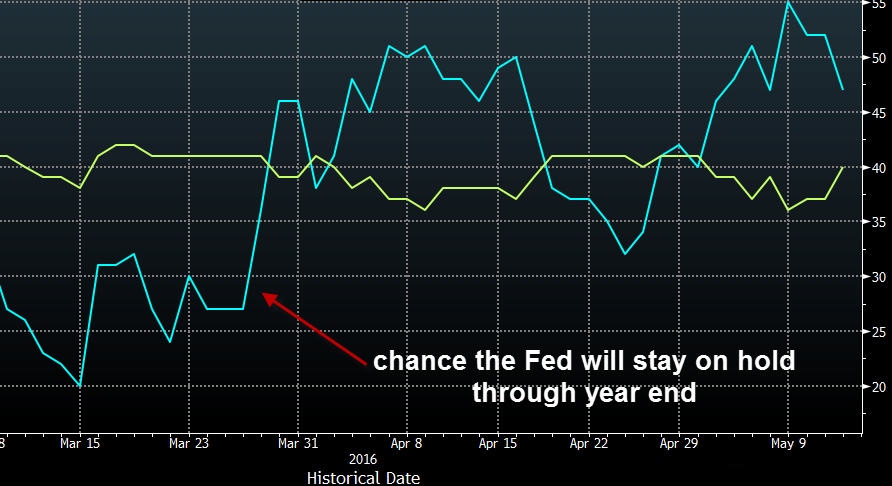

The market doesn't believe the Fed's forecast that it will hike rates twice this year. Even a single hike is only 53% priced into the Fed funds futures market by year end.

One of the reason the probability the Fed will stay on hold has risen in the past two months despite better risk appetite is weak retail sales.

The low-point on the chart on March 15 came just before the released of the February retail sales report. It showed the control group flat compared to +0.2% expected along with a revision of the January reading down to +0.2% from +0.6%.

Another reason the Fed is expected to stay on the sidelines is the March retail sales report. It showed the control group up just 0.1% compared to 0.4% expected, although the prior was revised two ticks higher.

The control group

The part of the survey to watch is the 'control group'. It's the line in the report that excludes the volatility autos, gasoline and building supplies components. It's what moves the market.

The metric has been sluggish since last July, climbing more than just 0.2% m/m once. In the past 8 months, the average has been just 0.129% -- the lowest over any 8 month period since 2012.

Remember that these numbers aren't adjusted for inflation so real core retail sales are nearly negative over that period.

For the coming month, the median economist estimate is +0.4% with forecasts ranging from +0.1% to +0.6%.

How to trade it

The market is hungry for a theme right now. The market has been trying to find a reason to buy the US dollar that never seems to come.

Still, the dollar overcame a weak non-farm payrolls report and there is some true in what the Fed says about the inevitability of more consumer spending at some point.

Given the market's ability to shake off bad USD news there are two trades: 1) Buy USD and hope for a strong number 2) Buy any kneejerk lower on a soft report.

The standing trade on this report is to trade any divergence in the control group vs advance sales numbers. Always go with the control group.