The Reserve Bank of New Zealand announce their latest monetary policy decision, due Thursday (10 December) morning local time

- Wednesday 9 December 2015, 2000GMT

- Governor Wheeler speaks at a press conference 5 minutes after the announcement, at 2005GMT

- 4 hours later Wheeler appears in front of a parliamentary committee (at 0010GMT)

We've posted up a few previews already:

- Barclays narrowly expect the bank to cut rates

- Mike had: Plenty of economists expect the bank to cut

- And Greg has his Technical preview here

-

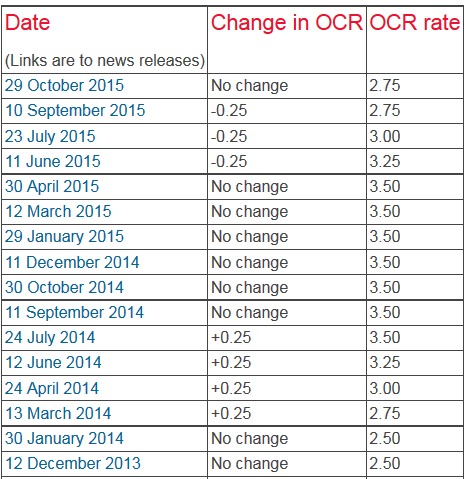

The current cash rate in NZ is 2.75%

The bank hiked during 2014, but has unwound much of it since:

While economist expectations are for a cut:

- Reuters survey shows 21 of 24 looking for a cut

- Bloomberg have 15 of 18

... Market pricing is showing traders are not so certain ... current OIS pricing shows a 62% probability of a 25bp cut

I reckon the market is much closer to the probability than summing the economists' views shows ... this is a very close call.

In favour of a cut are arguments such as the very low rate of inflation, which has been low for a long time, and also the concerns within the RBNZ on the level of the NZD. A rate cut would help to lower the NZD, at the margin, and also help to raise inflation (by making the price of imported goods and services more expensive, for example.

- Further slides in dairy prices will also weigh on national income ... and no, cutting rates won't boost international dairy prices, what it will do is make interest payments easier for indebted business and consumers.

- Terms of trade more broadly fell again in the 3rd quarter

Arguing against a cut is the recent bounce back in the economic data, indeed ANZ argue that the NZ "economy is "running faster than many realise"". ANZ economists put their money where their mouth is too, they are one of the only three Bloomberg survey participants not tipping an RBNZ cut tomorrow.

- Of concern to the RBNZ too is the Auckland housing market, although price gains have moderated somewhat.

- Population growth continues to power ahead.

- Solid consumer spending

Arguing also against cutting is the 'wait and see' on the Federal Reserve decision next week. A Fed rate hike should see a negative impact on the NZD ... though a hike is generally expected now so there may not be the expected gain for the USD.

On balance I am in the 'rate cut' camp from the RBNZ. Like I said, this is a close call, but I think the RBNZ will err on the side of a cut in order to work on giving inflation a boost and weakening the NZD. My conviction on the cut is not high, but on balance I think its more likely than not.

Further guidance from the RBNZ I would think will be fairly neutral ... that there remains scope for more cuts if necessary, but they are now in wait and see mode. I'd expect them (especially Wheeler in his press conference to follow the announcement) to jawbone the NZD lower.