The Bank of England meet today (London time, announcement due at 1100GMT)

Bloomberg report their median consensus forecast is for a 25bp cut

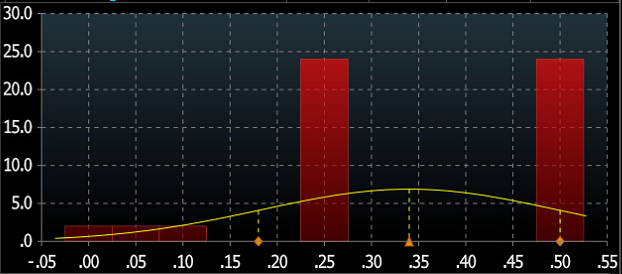

Which brings me to my first question ... checK out this diagram of estimates:

What big red columns show is the forecasts for the base rate (currently at 0.5%). Maybe its my old eyes, but I cannot see any difference at all between the height (which represent number of forecasts) of the 0.25% and 0.5% columns. Maybe there is a difference, but its not much.

So, the question is, is the 'expected' really a cut of 25% or is it better to say it's a line ball? This could have implications for market behaviour following the announcement.

OK, onwards. More questions:

There has been a huge fall in the value of GBP. This is, effectively, a stimulus to UK industry (mot just man, but tourism, for example). How will this impact on the BoE decision today? It will make a cut less likely, but the question is how much of an impact will it have?

There is a new government (congratulations Theresa May, and well done appointing BJ as foreign secretary, I love your wicked sense of humour already!), will there be fiscal stimulus to try to address fears of a post-vote economic slowdown? Yes, no? Too early to say? How will the BoE judge this?

And, another question, and back to the falling GBP - a lower currency should impact on higher inflation (higher price of imported products and services, and import-replacement items also marked higher in price). How will this impact on the decision today?

Which brings me to the QE question - will the bank do more of this, hold off,

Sorry for all the questions, but there you go!

Comments/answers welcome in the comments section.