The quid looks quite resilient after the GDP data

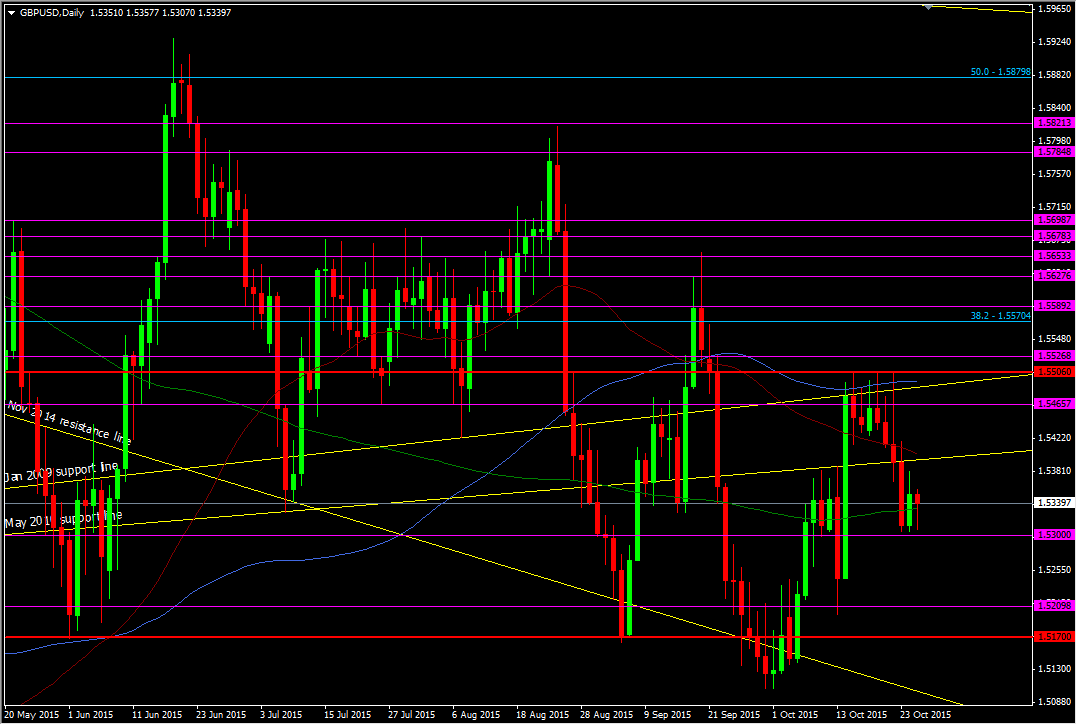

1.5300 is developing into strong support and it stands out in the middle of the current range. That range (between the red horizontal lines) I'm looking at is the 1.5170 - 1.5500/10 range

GBPUSD daily chart

There's quite a lot of technical noise around here and there's some valid levels. Aside from 1.5300, 1.5190/1.5220 has played a part going back through the year. 1.5170 has become important as support. Despite breaking it several times, we only came close to trying for a proper break 1st Oct. That failed and back above we went. The 200 dma hasn't been doing much at 1.5335 but the old May 2010 support line has. That's at 1.5395. Above there the 55 dma has been a level to lean on both ways recently. Then comes the area from around 1.5460/70 up to 1.5500/10

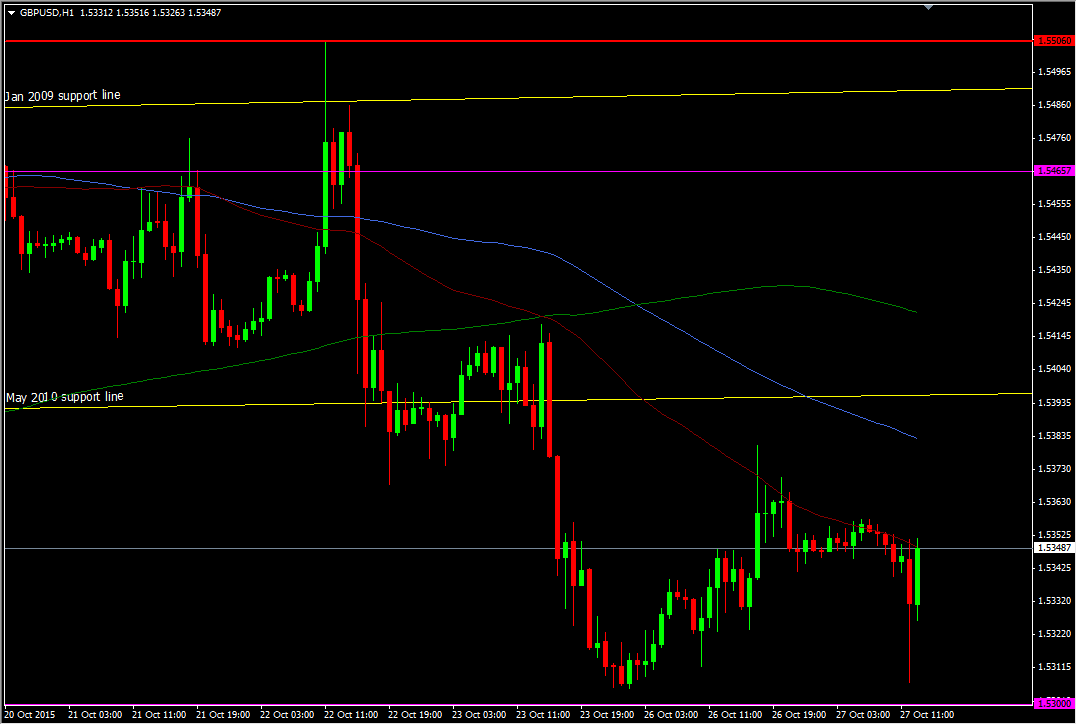

Have a look at the hourly chart and we can see where traders have been leaning against yesterday and today

GBPUSD H1 chart

Sometimes the tech can be a hindrance when there's a lot, and if I feel that there's too much going on I just focus on the wider picture and find the big levels that if broken, could push us to another place with a big move. There's plenty here for those that want to trade the levels but you've got to be nippy and ready to take a quick profit if it comes between the levels

So why might this time be different for the pound on softer data?

Well, what have we learnt over the last few months regarding the pound?

We've learnt that any rallies have been smashed back on bad data, even minor misses, as the market ties bad news with rates hikes being pushed back further. Today we lost the best part of 50 pips on the release and we've gained them back already. That tells me that the market isn't seeing any major problems in the data and perhaps that the market is now settled in its rate expectations. Most of the market thinks that we're going to be well into the latter part of 2016 before we get the first hike. That's looking priced in now

If so that changes the sentiment. Now, instead of waiting for bad data to confirm thoughts of pushing back rates hikes, pound traders will take bad news in their stride. That turns the table slightly and means that anything that changes those thoughts, changes the trade. The market is set for bad news so the risk is now good news.

I'll still wait for further confirmation of these thoughts as we get more news and data but looking for these early clues means you can get yourself ready to see a change in directional bias