Steady AUD/USD a theme in New York trading

The Australian dollar is up nearly 10 cents in the past two months as commodity prices and risk sentiment improved.

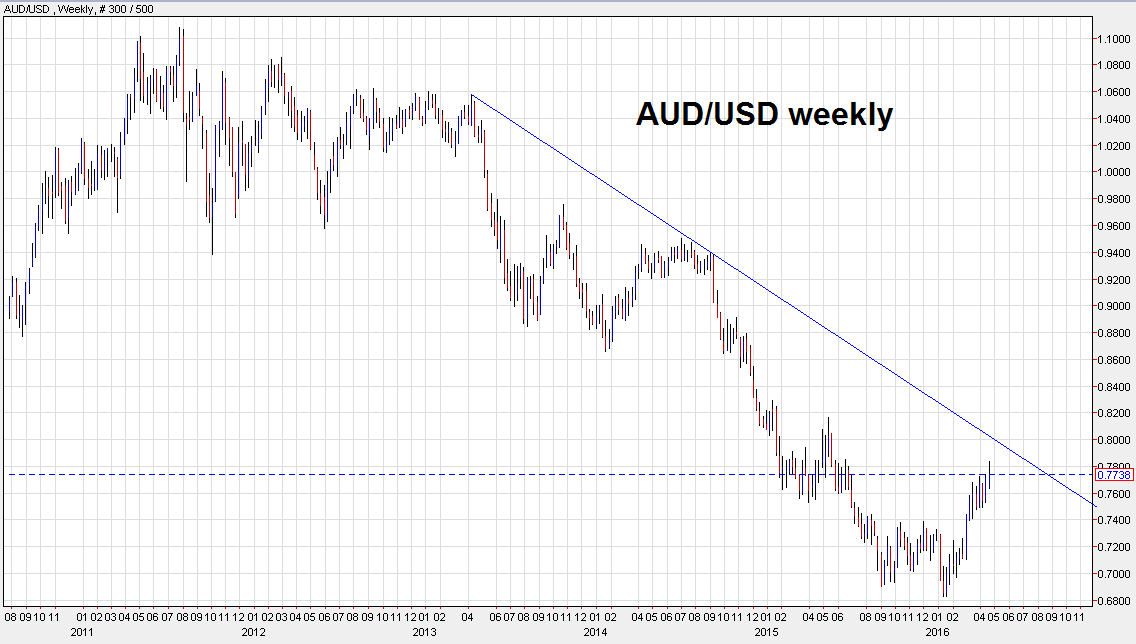

But today after touching a fresh 9-month high of 0.7836 the pair almost immediately reversed and sank to 0.7733. That could be a topping sign but first, let's look at the chart.

The weekly chart shows how small the rebound really is. This pair has been absolutely hammered over the past three years. It's not even in the range of any Fibonacci levels and the 100-day moving average is up at 0.7945, near where the downtrend kicks in.

Zooming in, the daily chart has been impressive, especially the turnaround after the gap lower at the open.

What leaves me weary about betting against AUD/USD is that the magnitude of today's reversal is still relatively small. The green bullish engulfing candle from Monday is a much better example of a technical signal because it's so much larger than the candles around it. Today's move looks more like a minor correction back to the March 31 high.

What I'm wary about is the commodity market. Iron ore has been extremely strong despite China talking about bringing back on more production. Oil has surged despite wave after wave of negative news.

That dynamic can easily unwind and begin to weigh on AUD/USD but we'll need stronger signs than today's reversal.