Production slowing (and the market is catching on)

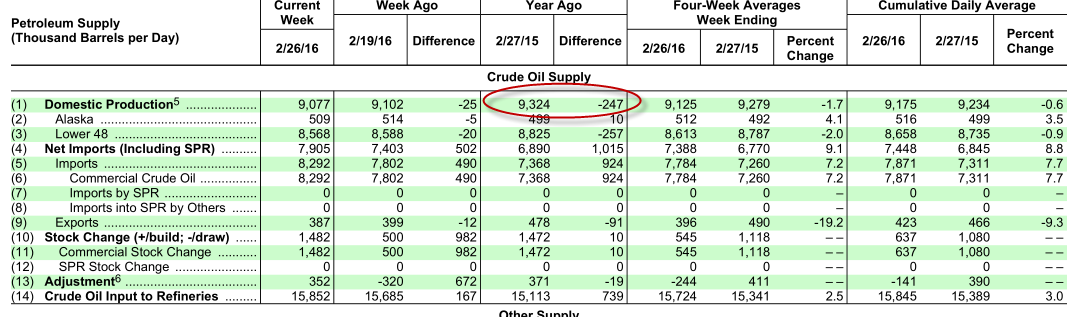

A little-known line in the weekly US oil storage report from the Energy Information Administration focuses on production.

The market is overflowing with oil at the moment but that won't stop until production slows. It takes some time for falling rigs and low prices to translate into softer production but it might be filtering through now.

This week's report showed a 2.65% decline in production year-over-year. That's not much but consider that in early February production was up 0.4% y/y.

This is the sequential decline since the week ending Feb 5:

- -0.4% y/y

- -1.6% y/y

- -2.0% y/y

- -2.6% y/y

So current production is running at 9.077 million barrels per day but that's down from 9.214 mbpd. That's a nearly 1.5% decline in a month and the first real break in that metric since the rout began.

200K barrels per day of production declines aren't going to balance the market but it's a start.

And now oil bulls appear to be paying attention because crude is ripping higher.