WTI crude down 83-cents to $59.89 per barrel.

The weekly Baker Hughes data is due at 1 pm ET (1700 GMT). It's the same time as Yellen's speech and that doubles the risk for oil traders. Crude fell 70-cents on the US dollar jump earlier and may fall again if Yellen is hawkish.

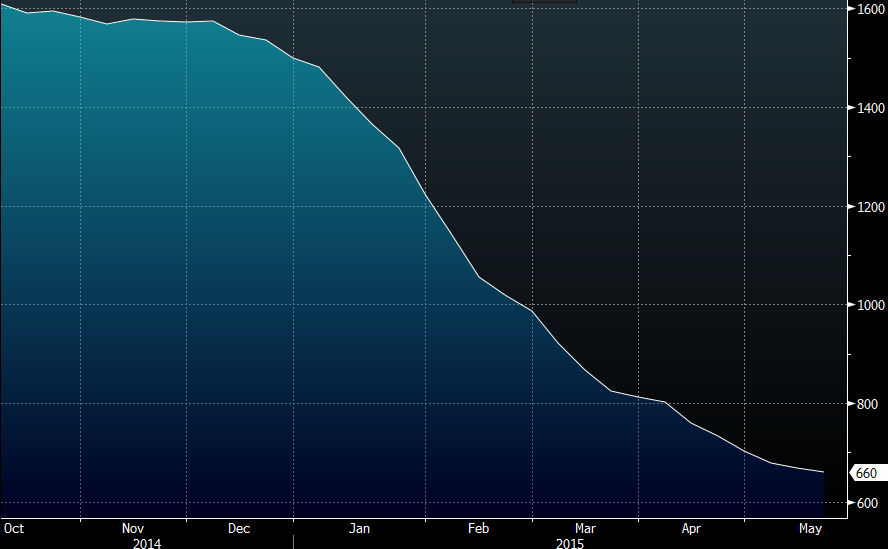

Current US oil drilling rigs sit at 660 but the decline is slowing. Last week, just 8 rigs went offline. There is even chatter about a rise in drilling rigs this week.

In any case, the report has lost the imagination of the market so the impact might be diminished.

The major event the market is building toward is the OPEC meeting on June 5.

There have been many signs that production quotas won't change but it was a similar story in October and when the official announcement hit, crude prices tanked and continued to fall for weeks.

Marketwatch takes a closer took at the decision.

On crude itself, I think the defining event for the remainder of the year will be Iranian oil returning to market. That will add a major supply source and restart declines. As always, timing the trade is key.

I'm bearish on oil (and short) but what looked like a breakdown this week was quickly reversed after a larger supply drawdown in the API/EIA reports.

WTI daily