Rate was centered around 0.7200 before cut

Typically, a cut leads to a fall in a currency. There may be a corrective move higher that takes the price back toward the price that traded before the cut.

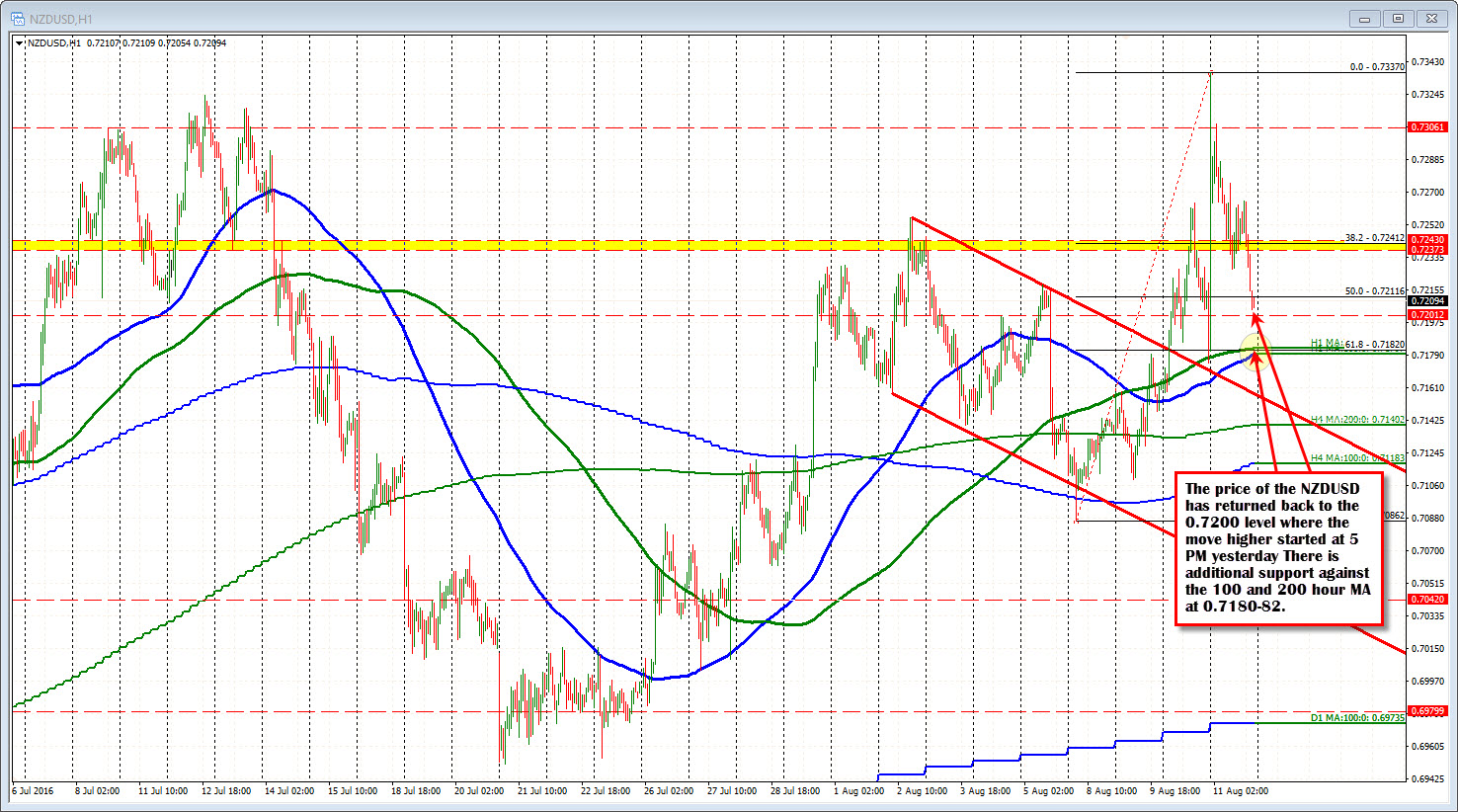

For the NZDUSD, the central bank cut by 25 basis points and the price shot right higher. The price just before the cut was plus or minus a few pips around the 0.7200 level. The high shortly after the cut, reached 0.7337.

Since then, the high corrective price moved to 0.7308 and the pair has moved lower in the NA session helped by USD strength. The low for the NA session came in at 0.7204 - just above the level just before the announcement. The lap has been completed.

Techncally, the price has just moved below the 50% of the move up from the August 8 low to the post RBNZ high. That level comes in at 0.72116. That is more bearish.

The 100 and 200 hour MA however are just below at 0.7180 and 0.7183. I would expect that if the selling continues, that buyers would lean against those levels on a test.