These moves are tuning into uncontrollable ones and that's the type that the BOJ don't want

The chatter has grown about BOJ intervention and it's all been overblown as usual. The BOJ are not going to step in to stop moves of a few hundred pips. Before today I would have said that there's no way they would step in, even given the drop since the Fed hike. They're not that short-termist. Most major central banks aren't. Given how far the yen has fallen over the last few years they will be well aware that they might see it rise and they will be prepared to let it go where it wants, within reason.

And that's the big caveat. As long as the FX market is functioning properly and moves aren't excessively volatile then they'll sit on their hands and just jawbone. They are not interested in jumping in to every 200 pip move. The time they will be concerned is when the moves increase in volatility and that's what we're starting to see now. Note, I say "starting to see". For us watching and trading everyday these are volatile moves. But we're mostly made up of traders who trade intraday and so we get caught up in the moment, the adrenalin gets pumping and we see things that are bigger than they are.

If there's one great trait of central banks (the big ones) it's that they don't get caught out by the noise. They don't start pulling their hair out over moves of a few hundred pips.

When could they intervene?

All that said, a 400 pip move in less than 24 hours, on top of what we've just seen these last couple of weeks, is pushing the boundaries of volatility. Now we're getting closer to when the BOJ will think about intervening. If I had to pick a number right now then 110 would be the first point that the BOJ might (heavy emphasis on might) think about jumping in, but it all depends on how we get there. If we breach 111.00 and then 110.00 soon and with the same type of volatility and speed we've seen today then that will increase the chances of them stepping in. If we consolidate around here and, say, 114-115 for a few sessions, then have a more measured break down through 111 & 110 there will be less risk of intervention.

Now here's the big warning

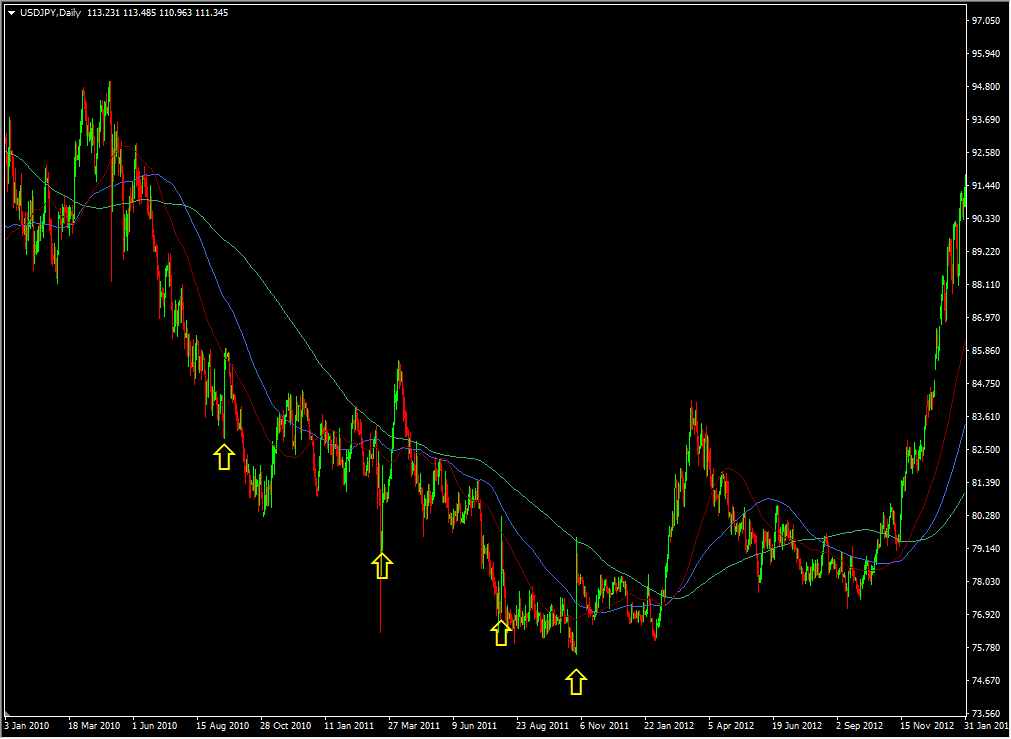

If you're expecting your long positions to be saved and the price sent all the way back to over 120 and stay there, then forget it. Back when the BOJ we're intervening at the bottom around the 75-80 levels intervention was worth around 300-400 pips each time and each one failed not long after

Prior BOJ intervention

Only the March 2011 intervention had a longer lasting effect as it came with G7 backing not long after. In reality, the G7 backing had greater effect than the actual intervention.

They are very unlikely to receive the same backing now and could quite possibly get some negative comments from the US and others about intervening. They've had their free throws of the dice and to go again will bring criticism, unless it's to stop worse volatile moves, because even the US won't want that, despite the benefit of a falling currency.

Let's say they do jump in, when could it happen?

The last one they did (31st Oct 2011) came in the early Asia afternoon on a Monday. The one before (4th Aug 2011) came on a Thursday, the second (18th Mar 2011) a Friday and the first (15thg Sep 2010) a Wednesday. So, there's no definitive day but if I recall correctly, they reasoned the last two at the end/beginning of the week to try to maximise the impact. Remember though, intervention doesn't have to come in conventional Japanese hours, it can come anytime.

Don't get caught up in the market hype

Whatever the BOJ do the market now has another bone to chew and it won't let this one go. All we're going to hear about is when, how, what and where the BOJ will step in. We'll get talking heads out of Japan and everywhere else and the market will start getting overexcited. The advice I'd give is step back from the noise and try and think from the Japanese point of view about what conditions would bring intervention. That won't be USDJPY bouncing in a 400 pip range, that will be it moving in 400 pip clips quickly, like we've seen since yesterday. We will be at the mercy of any intervention and we are unlikely to see it coming. Make sure your positions and risk reflect that. If you're short and trade short term, and want to hold a position overnight or when you won't be online but at the risk of intervention, then put in disaster stops. Those are stops that may keep you outside of the short term noise but won't have you 300 pips offside if you switch on your platform and find that the BOJ have pulled the trigger. If the trading conditions and risk has altered then we must adjust with it.

We at ForexLive will do our best to look through the fervour that will come from the news and we'll try to gauge if and when intervention will be more likely or not. But, it's just as much a lottery for us as it is for you, though we might have a better idea of the signs that might pre-empt it.

Stay safe folks