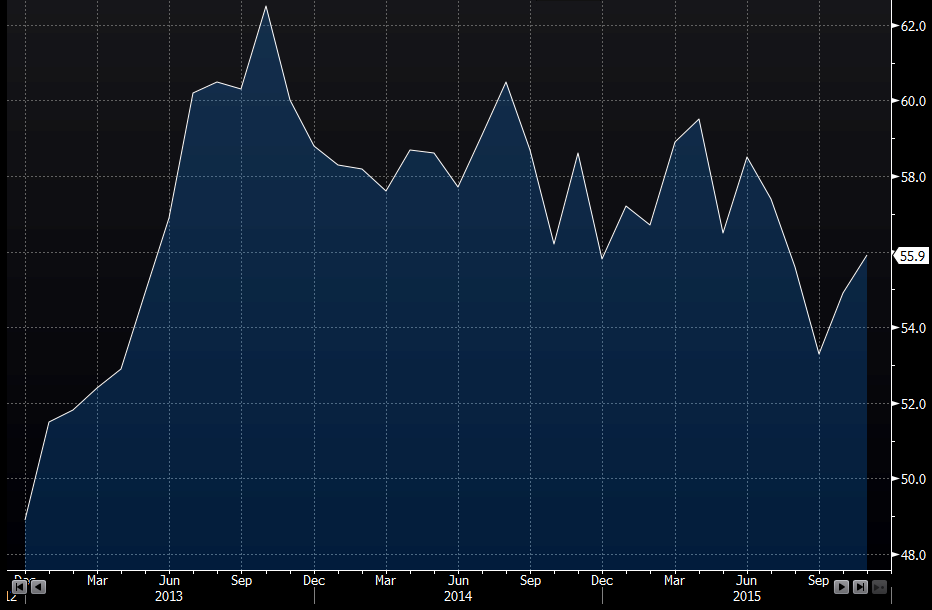

Details of the November 2015 UK Markit CIPS services PMI data report 3 December 2015

- Prior 54.9

- New orders 56.7 vs 55.0 prior

- Composite 55.8 vs 55.0 exp. Prior 55.4

- New orders 56.2 vs 55.2 prior

Both the services and composite, and both new orders, are at the highest since July

The pound is taking no notice of the better numbers as its funk continues. We couldn't even sustain a measly 10 pip gain and instead fell to 1.4905. That tells us a lot about the mood right now

Markit says the number represents Q4 growth of around 0.6% q/q vs 0.5% in Q3

Jobs growth remained strong but was at the slowest pace in 3 months

Prices rose on both sides. Input costs were up further, mainly on the back of the incoming new National Living Wage. That pushed the survey inflation counter to a 4 month high. Prices being charged were up a touch

Markit's Chris Williamson had this to say;

"The rate of job creation remained resiliently robust in November despite widespread difficulties finding suitable staff and worries about the introduction of the National Living Wage, in turn leading to reports of rising wages. "For now, falling oil and energy costs are offsetting rising wage growth and keeping a lid on inflationary pressures, but the upturn in earnings growth raises question marks over just how long inflation, and therefore interest rates, will remain low for."

UK services PMI