FOMC preview from Danske Bank

The FOMC meeting concludes on Wednesday. We expect it to maintain the target range at 0.25-0.50%, in line with consensus, due to the presidential election next week.

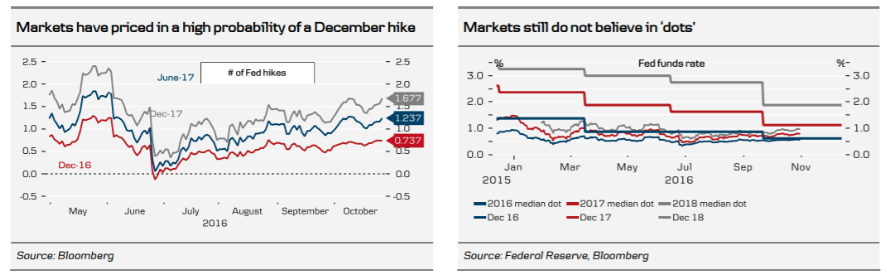

It is one of the small meetings without a press conference or updated 'dots', therefore, the most interesting part is the FOMC statement. The Fed more and less pre-announced the December 2015 hike at the October meeting but, , this time, unlike last year, the markets have now more or less priced in a Fed hike by year-end as much as possible given that there are still one and a half months before the December meeting. Hence, we do not expect any major changes to the FOMC statement at this meeting, as it was already quite hawkish last time, as it stated that the case for a rate hike had 'strengthened'. It may say that economic data have supported its view that growth has picked up pace.

We have, for some time, had this non-consensual view that the Fed will not raise the Fed funds target range this year. While this call has come under pressure given the better US economic data, we still think it is too early to say a December hike is done deal although admittedly the probability has increased significantly.

We still have some important data releases left (not least two jobs report) before the Fed has to make up its mind so we intend to continue monitoring incoming data, as there are still valid arguments for not hiking this year at all. The FOMC members were very divided at the latest FOMC meeting back in September as three voted for an immediate hike while three members indicated that Fed should not hike at all.

For bank trade ideas, check out eFX Plus.