All eyes on the US Non-Farm Payrolls and wages data at 13.30 GMT 2 Dec

After a lively week it's understandable that traders and robots are in pause mode this morning.

Yes we've seen some decent GBPJPY selling and yen demand in general, and the euro has dribbled lower but compared to recent sessions it's been decidedly comatose as we wait to see what clues this month's NFPs bring.

Large EURUSD option expiries at 1.0600, 1.0650 and 1.0700 also combining to produce a bit of a stalemate. Yesterday's impact into and post-expiry was clearly evident as indeed were the 1.0200 USDCHF expiries amongst others.

Whether we'll be any wiser on US rate hikes after today's data remains to be seen but it should wake the re-active robots up at least and provide some short term volatility to trade into.

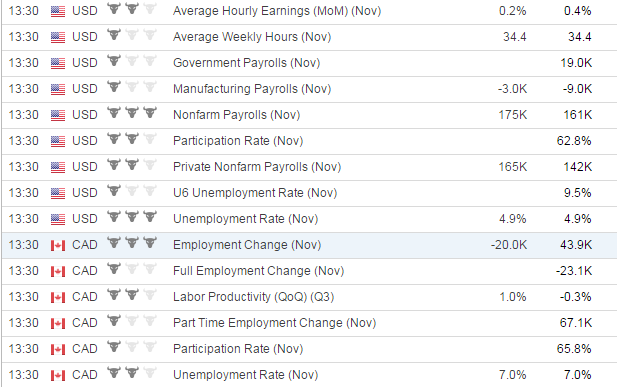

Here's the data expectations inc the Canadian jobs release: