Move over Letterman! Oh, he already has. OK then. Here is the Morgan Stanley with its 2016 FX outlook and top 10 trades.

The following are the key points in MS' outlook along with the list of its top 10 trades and their related rationales.

FX outlook: The Framework:

"The JPY should join the USD in outperforming relative to its G10 peers and most of EM, in our view.

Repatriation flows have pushed USD higher, as EM portfolio outflows have led to EM weakness.

Going forward, deleveraging-related EM outflows should allow a bigger degree of differentiation.

Unlike the Fed tightening cycle that began in 2004, higher US rates will likely weaken EM currencies.

Low local investment returns and rising funding costs create balance sheet pressures.

Increasing DM-EM divergence should push real EM funding costs higher, encouraging some EM central banks to run accommodative monetary conditions.

We sell most AXJ currencies (except INR and PHP).

EUR and CHF are preferred funding currencies, while we think JPY is likely to rally," MS projects.

Top Trades for 2016:

1- Short GBP/JPY: Performs best in a risk-off and Brexit scenario.

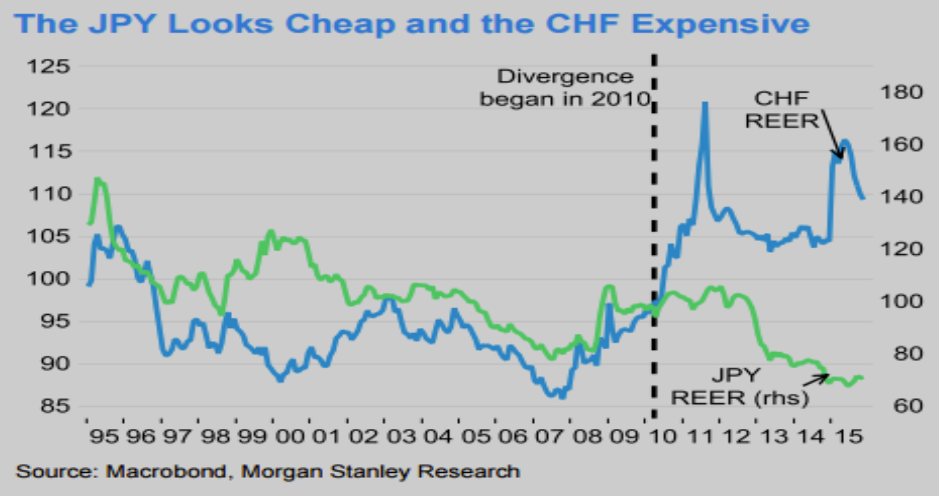

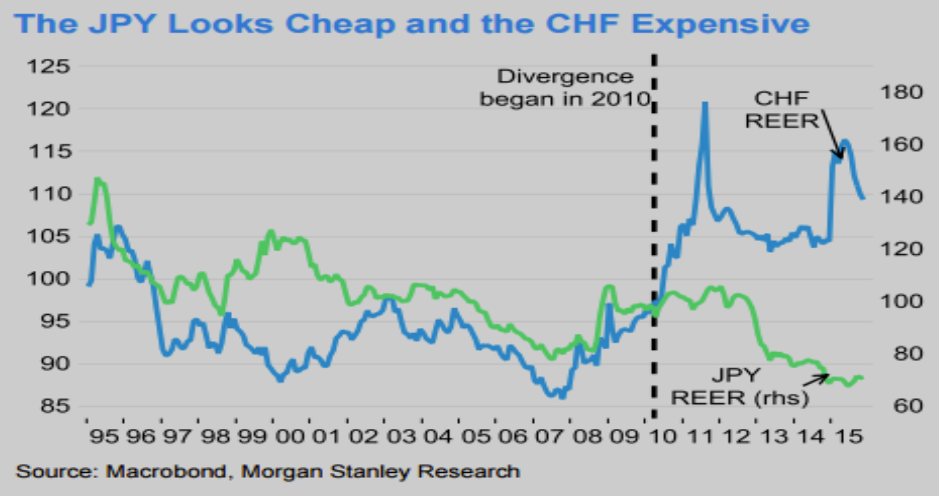

2- Short CHF/JPY: Relative FX valuation and diverging monetary policies favour the JPY.

3- Long USD vs AUD, CAD, NZD and NOK Basket: Terms of trade weakness and commodity dis-investment should keep commodity FX offered.

4- Long USD vs SGD, TWD and THB Basket: Deleveraging Asian balance sheets create USD demand.

5- Long JPY vs KRW and CNH Basket: A trade benefiting from valuation differentials and Asian balance sheet deleveraging.

6- Short EUR/INR: A carry trade benefiting from high INR rates and a dovish ECB weakening the EUR.

7- Short EUR/MXN: The MXN should benefit from relatively unleveraged balance sheets and strong US trade.

8- Long USD/BRL: We expect a downgrade to non-investment grade, which should drive capital outflows.

9- Long USD/PLN: Upcoming changes to the NBP may bring about new risks for PLN, and widen the USD supportive yield spread.

10- Short CAD/RUB: RUB should benefit from fairer valuations and high yield support. Funding via CAD partially reduces oil sensitivity.