Being dubbed as their "Trade of the week", the recco was out in their FX note last week

Last week Morgan Stanley went short NZDUSD, and now they want to go short AUDUSD.

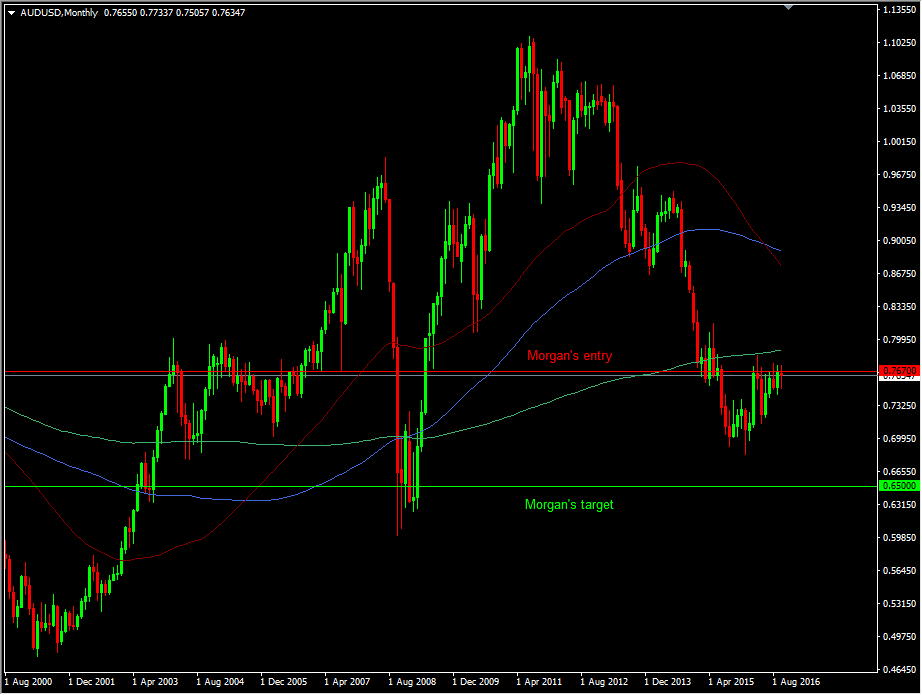

They want to short at 0.7670 with a stop at 0.7750. Funnily enough, their TP level is the same figure as their kiwi trade at 0.6500.

Their reasoning;

"We see AUD vulnerability coming from four angles. First, China has achieved better than expected GDP growth, but it appears the economy has become more unbalanced. We expect China to slow down from here. Second, the USD is expected to rally with the help of steeper yield curves. Third, Australia's labour market has developed early weakness. With mining investment staying weak and housing slowing down, two important pillars for employment

growth have weakened. Fourth, the new RBA Governor Lowe seems to be leaning towards the dovish side. The risk to this trade is a rise in iron ore prices."

That's one hell of a risk/reward ratio, particularly at a target level not seen since early 2009.

Morgan Stanley's AUDUSD short strategy

What's also a bit strange is that they issued this call on the 20th seemingly after it had traded their level anyway. We'll keep an eye to see whether this gets filled or not with the price currently at 0.7631 off a high of 0.7641.

You wise folks had a fair bit to say about their kiwi short so what about this one?