I posted a little earlier on Goldman Sachs and the European Central Bank (ECB) decision

Goldman Sachs expect the EUR/USD to fall 300 points

Its attracted a lot of interest, unsurprisingly, so a bit more detail direct from GS now (bolding mine):

- Our rationale boils down to the following. If the ECB eases again tomorrow, something that President Draghi essentially pre-committed to in October, it will mean that the ECB has eased twice in 2015, precluding further easing on a reasonable horizon.

- It is thus important - both for ECB credibility and, more important, for reversing the lowflation dynamic - to make tomorrow's easing a material event, i.e. to surprise the market.

- We continue to think that the hurdle in this regard is relatively low and see a 2-3 big figure drop in EUR/$ on the day, with parity by yearend and 0.95 (our 12month forecast) potentially reached as early as end-March.

The note goes on ... but Brooks does address the positioning argument,:

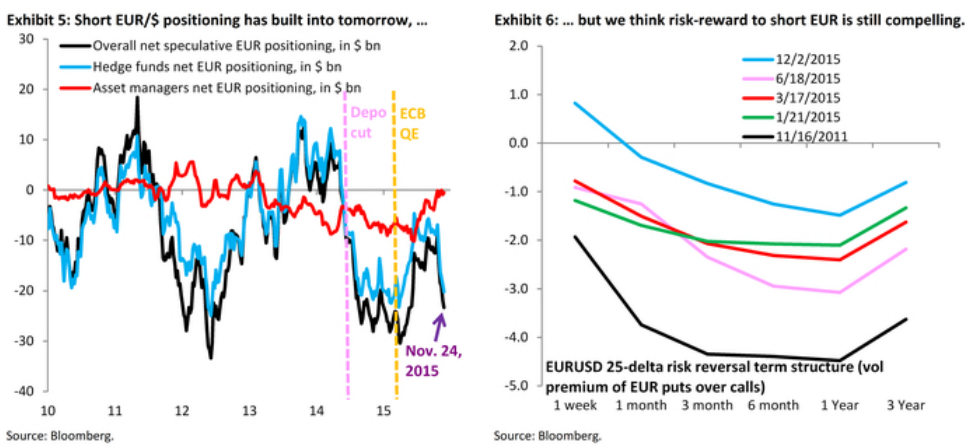

- Certainly, it is true that speculative shorts have built in the CFTC data ... but - as we have shown in past research - that subset of the market tends to lead, i.e. broader positioning is likely more modest.

- And of course it remains the case that downside skew in EUR/$ is modest compared to the runup to the Jan. 22 meeting.

- In short, we think risk-reward to short EUR/$ into tomorrow's meeting remains compelling and we anticipate a 2-3 big figure drop on the day