I posted earlier the summary from Goldman Sachs on their tip for the next FOMC interest rate move:

Goldman Sachs on the wires - see next Fed rate hike in June (from March)

This was the summary:

- GS now tipping June for the next Federal Reserve rate hike

- They were tipping March but have slipped it back 3 months

More:

Note from chief economist Hatzius

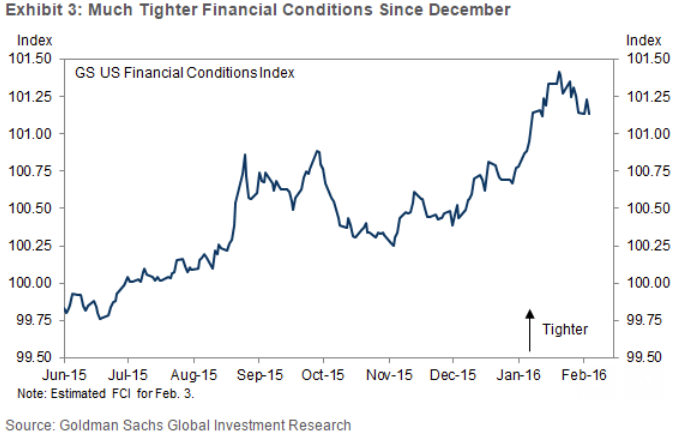

- financial conditions have tightened "meaningfully"

- Fed will wait for more data & observe market developments

- GS still expecting 3 hikes this year

(dream on)

- Risks are to the downside though

(that's more like it)

- An April hike is possibility if mkt conditions improve

--

More here, if you want it:

They say a picture is worth a 1000 words ... but what if its a picture of words? Yours at 1,000.

And, more from GS:

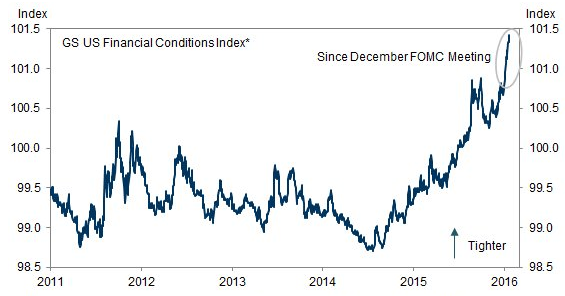

And that graph from Goldman Sachs reminds of one I posted from them about 3 weeks ago - a longer look at the tightness of financial conditions