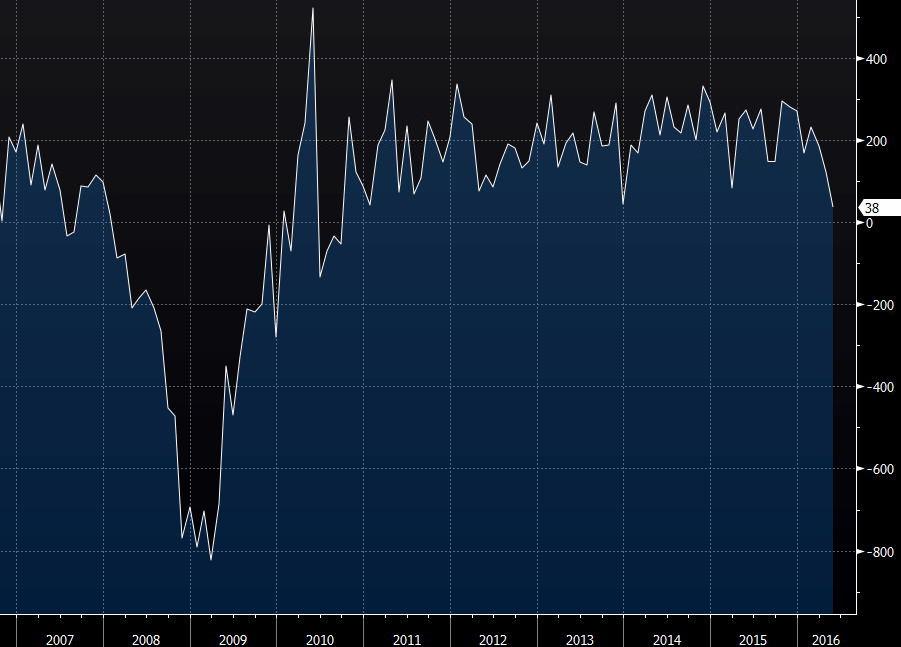

May 2016 non-farm payrolls report results

- Worst reading since Sept 2010

- Prior non-farm payrolls 160K (revised to 123K)

- Two-month net revision -59K

- Unemployment rate 4.7% vs 4.9% expected

- Participation rate 62.6% vs 62.8% prior

- Average hourly earnings 0.2% m/m vs +0.2% m/m exp

- Prior avg hourly earnings revised to +0.4% from +0.3%

- Average hourly earnings 2.5% y/y vs +2.5% y/y exp

- Average weekly hours 34.4 vs 34.5 exp

- Prior avg weekly hours revised to 34.4 from 34.5

This isn't a good time to buy US dollar dips. There were worries the Verizon strike would cut 40K jobs but that still leaves 80K jobs missing, and another 59K lost for revisions.

The drop in the unemployment rate is notable but it's entirely on falling participation.

Naturally, the Fed won't want to hike in two weeks after this report and July suddenly seems far less likely than the 50/50 probability in markets.